The foreign exchange market, commonly known as Forex, is a decentralized global marketplace where currencies are traded. It’s a massive and volatile market, attracting both seasoned investors and newcomers alike with the allure of high potential returns. However, the reality is that a significant portion of individuals who venture into Forex trading ultimately experience financial losses. Understanding the factors contributing to these losses and managing risk effectively are crucial for anyone considering participating in this complex market.

Prevalence of Losses in Forex Trading

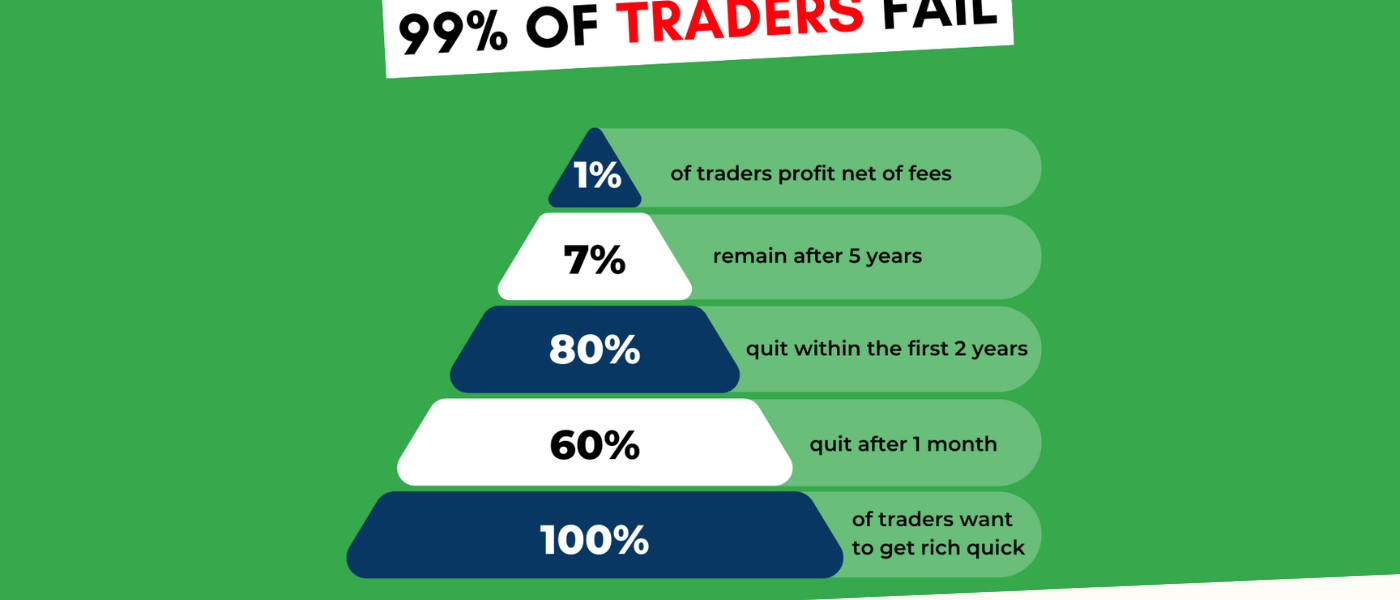

Pinpointing an exact percentage of Forex traders who lose money is difficult due to the decentralized nature of the market and varying reporting requirements across different regions. However, studies and disclosures from brokers often reveal a concerning trend: a substantial majority of retail Forex traders lose money.

- Broker disclosures often state that a significant percentage of retail accounts lose money trading CFDs, which often include Forex.

- Studies in various countries have indicated loss rates ranging from 70% to 90% for retail Forex traders.

This high loss rate highlights the inherent risks associated with Forex trading and underscores the importance of education and disciplined risk management.

Why Do So Many People Lose Money in Forex?

Several key factors contribute to the prevalence of losses in Forex trading:

Lack of Knowledge and Education

Many newcomers enter the Forex market without a solid understanding of its intricacies. They may lack knowledge of:

- Technical analysis

- Fundamental analysis

- Trading strategies

- Risk management principles

Emotional Trading

Emotions like fear and greed can lead to impulsive decisions and deviations from a well-defined trading plan. This can result in chasing losses or closing profitable trades prematurely.

Insufficient Risk Management

Failing to implement effective risk management strategies, such as setting stop-loss orders and managing leverage appropriately, can expose traders to significant financial losses. Overleveraging, in particular, can amplify both potential profits and potential losses;

Unrealistic Expectations

Some individuals approach Forex trading with unrealistic expectations of quick riches. This can lead them to take excessive risks and make poor trading decisions.

Choosing the Wrong Broker

Selecting an unreliable or unregulated broker can expose traders to fraudulent practices and unfair trading conditions. It’s crucial to research and choose a reputable broker with a proven track record.

Strategies for Minimizing Losses in Forex

While Forex trading inherently involves risk, there are strategies that traders can implement to minimize potential losses:

Invest in Education

Thoroughly educate yourself on the fundamentals of Forex trading, including technical analysis, fundamental analysis, and risk management principles. Consider taking courses, reading books, and practicing on a demo account;

Develop a Trading Plan

Create a comprehensive trading plan that outlines your trading goals, risk tolerance, entry and exit strategies, and money management rules. Stick to your plan and avoid making impulsive decisions.

Practice Risk Management

Implement strict risk management techniques, such as setting stop-loss orders to limit potential losses on each trade and managing leverage appropriately. Never risk more than you can afford to lose.

Control Emotions

Learn to control your emotions and avoid letting fear and greed influence your trading decisions. Stick to your trading plan and avoid chasing losses.

Choose a Reputable Broker

Thoroughly research and select a reputable and regulated Forex broker with a proven track record. Ensure that the broker offers fair trading conditions and reliable customer support.

FAQ: Forex Trading and Profitability

Q: Is Forex trading a good way to make money?

A: Forex trading can be a profitable endeavor, but it also carries significant risks. Success in Forex trading requires knowledge, skill, discipline, and effective risk management.

Q: How much money do I need to start trading Forex?

A: The amount of money needed to start trading Forex varies depending on the broker and the trading strategy. Some brokers offer micro accounts that allow you to start with as little as $100, while others require a larger initial deposit.

Q: Can I get rich trading Forex?

A: While it’s possible to make substantial profits in Forex trading, it’s unrealistic to expect to get rich quickly. Forex trading requires hard work, dedication, and a long-term perspective.

Q: What are the best Forex trading strategies?

A: There is no one-size-fits-all Forex trading strategy. The best strategy depends on your individual trading style, risk tolerance, and market conditions. Some popular strategies include trend following, range trading, and scalping.

Q: What is leverage and how does it work?

A: Leverage is the use of borrowed funds to increase the potential return of an investment. In Forex trading, leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also significantly increases the risk of losses.