The foreign exchange market, or Forex, is a global decentralized marketplace where currencies are traded. It’s known for its high liquidity and volatility, offering numerous opportunities for profit but also significant risks. Understanding current market trends and economic indicators is crucial before making any trading decisions. This article explores potential currency pairs and strategies to consider when looking for “what to buy” in Forex today, focusing on informed choices rather than specific recommendations.

Understanding Market Influencers

Before diving into specific currency pairs, it’s important to understand the key factors influencing Forex rates. These include economic indicators, geopolitical events, and central bank policies.

Key Economic Indicators

Economic indicators provide insights into a country’s financial health and can significantly impact its currency’s value; Here’s a brief overview:

- GDP Growth: Indicates the rate at which a country’s economy is expanding or contracting.

- Inflation Rate: Measures the rate at which prices for goods and services are rising.

- Unemployment Rate: Shows the percentage of the workforce that is unemployed and actively seeking employment.

- Interest Rates: Set by central banks, influencing borrowing costs and investment flows.

Geopolitical Events and Market Sentiment

Geopolitical instability and global events can trigger rapid shifts in currency values; Traders often seek safe-haven currencies like the USD or JPY during times of uncertainty.

Fact: Unexpected political announcements can cause major fluctuations in currency values within minutes.

Potential Currency Pair Opportunities

Identifying potentially profitable currency pairs requires careful analysis of economic trends and market conditions. Always conduct thorough research before making any investment decisions.

The EUR/USD Pair

The EUR/USD pair is the most traded currency pair in the world, representing the Euro against the US Dollar. Here’s a look at some factors influencing this pair:

| Factor | Influence |

|---|---|

| ECB Policy | The European Central Bank’s monetary policy decisions can significantly impact the Euro’s value. |

| US Federal Reserve Policy | The US Federal Reserve’s monetary policy decisions can significantly impact the US Dollar’s value. |

| Eurozone Economic Data | Data releases such as GDP growth, inflation, and unemployment in the Eurozone influence investor sentiment towards the Euro. |

| US Economic Data | Similar to the Eurozone, US economic data impacts the US Dollar’s strength. |

Emerging Market Currencies

Emerging market currencies can offer higher potential returns but also come with increased volatility and risk. Careful due diligence is essential.

Fact: Political stability and strong economic growth are key indicators of a healthy emerging market currency.

FAQ Section

Here are some frequently asked questions about buying currencies in the Forex market:

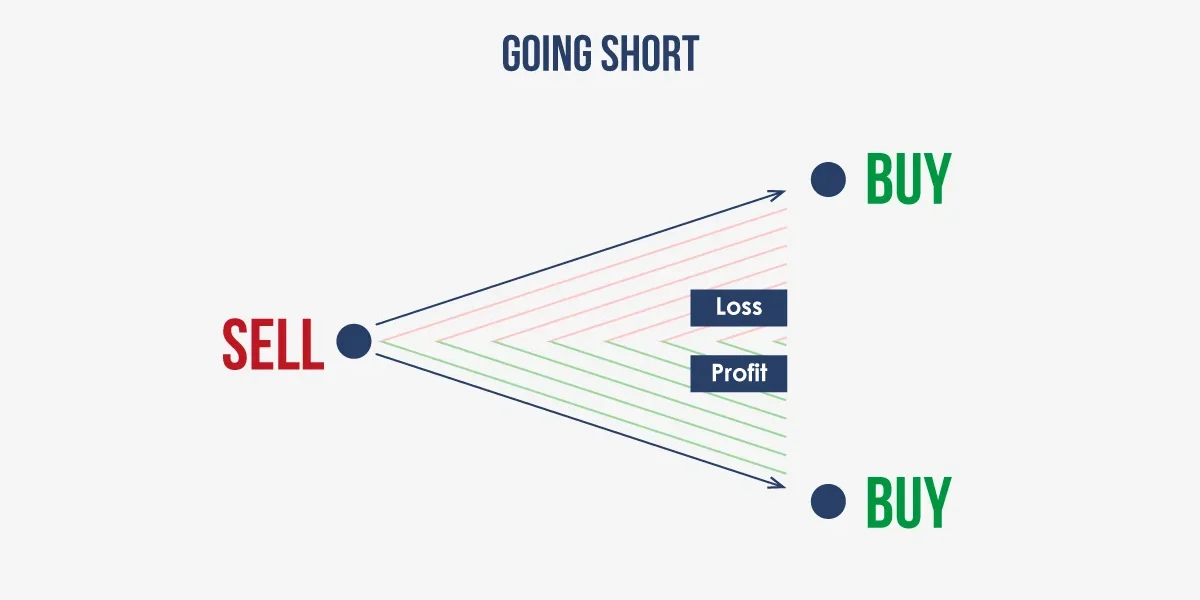

- What is Forex leverage? Leverage allows you to control a larger position with a smaller amount of capital, amplifying both potential profits and losses.

- What is a pip? A pip (percentage in point) is the smallest unit of price movement in a currency pair.

- How do I manage risk in Forex? Employ strategies like stop-loss orders, appropriate position sizing, and diversification to mitigate risk.

- What are the best Forex trading platforms? Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each offering different features and tools.

- How much capital do I need to start trading Forex? The required capital varies depending on the broker and your risk tolerance, but it’s generally recommended to start with an amount you can afford to lose.

Before making any decisions about what to buy in the Forex market, it’s crucial to conduct thorough research and understand the risks involved. The Forex market is dynamic and influenced by a multitude of factors, requiring continuous monitoring and adaptation. Diversifying your portfolio and employing risk management strategies are essential for long-term success. Remember, past performance is not indicative of future results, and the potential for loss is always present. Seek advice from a qualified financial advisor before making any investment decisions. Consider your own risk tolerance and financial goals when determining your trading strategy.