Insurance policies, while designed to provide a safety net in times of unexpected loss, aren’t limitless in their coverage. Understanding the inherent boundaries within these contracts is crucial for anyone seeking financial protection. Navigating the complexities of insurance requires awareness of these restrictions to ensure adequate coverage and avoid unpleasant surprises. These limits, often dictated by the policy’s terms and conditions, determine the extent to which an insurer is obligated to compensate a policyholder. Let’s explore three fundamental limits of insurance policies that every policyholder should be aware of.

1. Policy Maximums: The Ultimate Coverage Ceiling

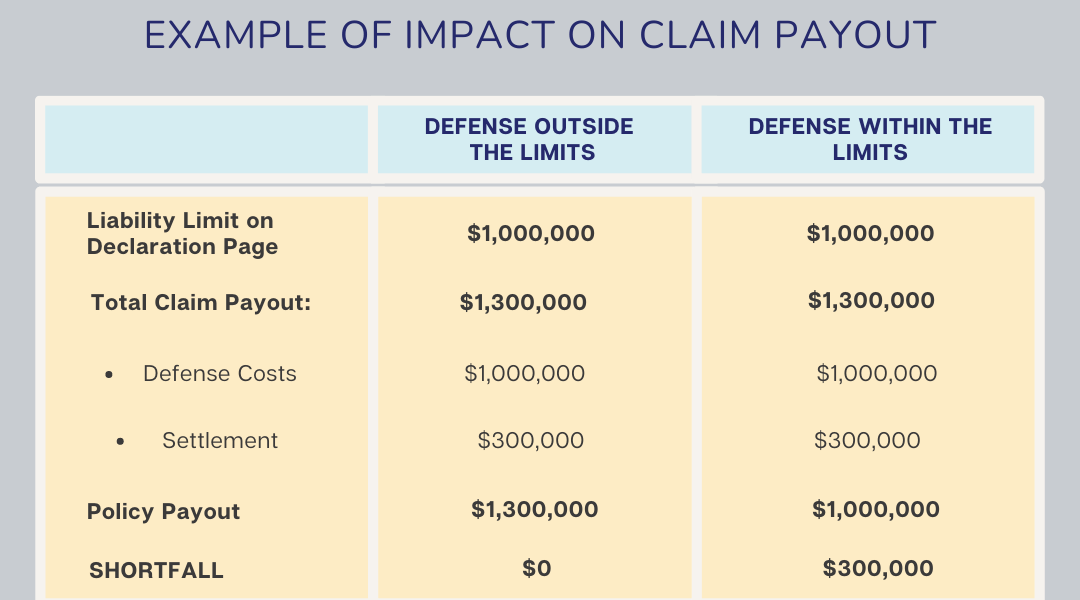

Every insurance policy has a maximum amount it will pay out for a covered loss. This “policy maximum” represents the absolute upper limit of the insurer’s financial responsibility. Think of it as the ceiling on your coverage. It’s crucial to select a policy with a maximum payout that adequately reflects the potential value of your assets and the potential costs associated with a covered event.

- Aggregate Limit: The total amount the insurer will pay out over the entire policy term, regardless of how many claims are filed.

- Per-Occurrence Limit: The maximum payout for a single covered event.

- Sublimits: Specific limits within the policy for certain types of losses (e.g., jewelry theft, water damage).

2. Deductibles: Your Out-of-Pocket Responsibility

A deductible is the amount you, the policyholder, are responsible for paying out-of-pocket before the insurance coverage kicks in. It’s essentially your contribution to the cost of a claim. Higher deductibles typically result in lower premiums, but also mean you’ll need to pay more upfront in the event of a loss. Conversely, lower deductibles lead to higher premiums but less out-of-pocket expense when a claim arises.

Factors to Consider When Choosing a Deductible:

- Risk Tolerance: How comfortable are you with paying a larger sum out-of-pocket?

- Premium Affordability: Can you afford a higher premium for a lower deductible?

- Potential Claim Frequency: How likely are you to file a claim?

3. Exclusions: What the Policy Doesn’t Cover

Exclusions are specific events, perils, or circumstances that are explicitly not covered by the insurance policy. These are clearly outlined in the policy documents and are just as important to understand as the coverages provided. Common exclusions might include acts of war, intentional damage, wear and tear, or damage caused by certain natural disasters (depending on the policy and location).

Examples of Common Exclusions:

- Flood Damage: Often excluded from standard homeowners insurance policies (requiring separate flood insurance).

- Earthquake Damage: Similar to flood damage, often requires a separate earthquake insurance policy.

- Intentional Acts: Damage intentionally caused by the policyholder or someone acting on their behalf.

- Wear and Tear: Gradual deterioration due to normal use is typically not covered.

Understanding these limits of insurance policies – policy maximums, deductibles, and exclusions – is paramount for making informed decisions about your insurance coverage. Failing to grasp these constraints can lead to unexpected financial burdens during times of need. By carefully reviewing your policy documents and seeking clarification from your insurance provider, you can ensure you have the appropriate level of protection and avoid any unwelcome surprises.

But beyond these foundational three, whisperings circulate in the shadowed corners of insurance lore – whispers of more esoteric limitations, constraints etched in fine print only decipherable by seasoned actuaries or those unfortunate enough to stumble upon them through bitter experience. These are the “phantom limits,” the unwritten rules that subtly shape the landscape of coverage.

The Phantom Limit: Moral Hazard and the Illusion of Invincibility

One such phantom is the unspoken limit imposed by “moral hazard.” This isn’t a fixed dollar amount, but a boundary defined by human behavior itself. Insurance, at its core, is designed to mitigate risk. However, the very existence of insurance can sometimes inadvertently increase the risk it’s meant to protect against. Think of the driver who, knowing they’re fully insured, takes slightly more reckless chances behind the wheel. Or the homeowner who postpones essential maintenance, relying on their policy to cover the eventual (and preventable) damage. This inherent tension between protection and carelessness creates an invisible limit, a point beyond which the insurer may scrutinize claims with heightened suspicion, questioning whether the loss was truly accidental or a consequence of willful neglect.

Moral hazard isn’t about outright fraud; it’s about the subtle shifts in behavior that occur when the burden of potential loss is partially lifted. It’s a reminder that insurance is not a blank check, but a shared responsibility – a pact built on good faith and a commitment to mitigating risk, not exploiting it.

The Algorithmic Abyss: Limits Defined by Data

Another emerging phantom limit lurks within the algorithms that increasingly govern insurance underwriting and claims processing. These complex equations, fueled by mountains of data, are designed to assess risk with unprecedented precision. But they also create a new kind of boundary – a limit defined not by explicit policy language, but by the cold, impartial logic of code. If your data profile – your age, location, occupation, lifestyle – flags you as a higher-risk individual, your policy may be subject to subtle restrictions, higher premiums, or even outright denial, even if you haven’t actually experienced any losses. This “algorithmic abyss” raises profound questions about fairness, transparency, and the potential for bias in the age of big data.

| Limit Type | Description | Potential Impact |

|---|---|---|

| Policy Maximum | The highest amount the insurer will pay for a covered loss. | If the actual loss exceeds the maximum, you’re responsible for the difference. |

| Deductible | The amount you pay out-of-pocket before insurance kicks in. | Higher deductibles lower premiums but increase your upfront costs. |

| Exclusion | Specific events or perils not covered by the policy. | You’re fully responsible for losses caused by excluded events. |

| Moral Hazard | Increased risk-taking behavior due to the presence of insurance. | Claims may be scrutinized more closely, and coverage could be denied. |

| Algorithmic Limit | Restrictions imposed based on data-driven risk assessments. | Higher premiums, limited coverage, or policy denial based on your data profile. |

The Unseen Boundary: Policy Lapses and the Forgotten Renewal

And finally, perhaps the most tragic limit of all – the unseen boundary created by a lapsed policy. Life gets busy, bills get misplaced, and renewal notices get buried in the digital deluge. But forgetting to renew your insurance can have devastating consequences, leaving you completely exposed to financial ruin in the event of a loss. This limit, born of simple oversight, serves as a stark reminder of the fragility of protection and the importance of vigilance. It emphasizes that insurance is not a one-time transaction, but an ongoing commitment – a constant tending to the financial garden that shields you from the storms of life. The limits of insurance policies are real, but the limit created by neglecting your policy is entirely avoidable.