Understanding a company’s financial health is crucial for investors and stakeholders, and the interest coverage ratio is a key metric in gauging its ability to meet its debt obligations. It essentially measures how many times a company can pay its interest expenses with its available earnings before interest and taxes (EBIT). This provides a clear indication of a company’s solvency and risk of default, offering valuable insights into its financial stability. The higher the interest coverage ratio, the better positioned a company is to handle its debt burden and unexpected financial downturns. In this guide, we will delve into the nuances of calculating and interpreting this vital financial ratio.

Understanding the Interest Coverage Ratio Formula

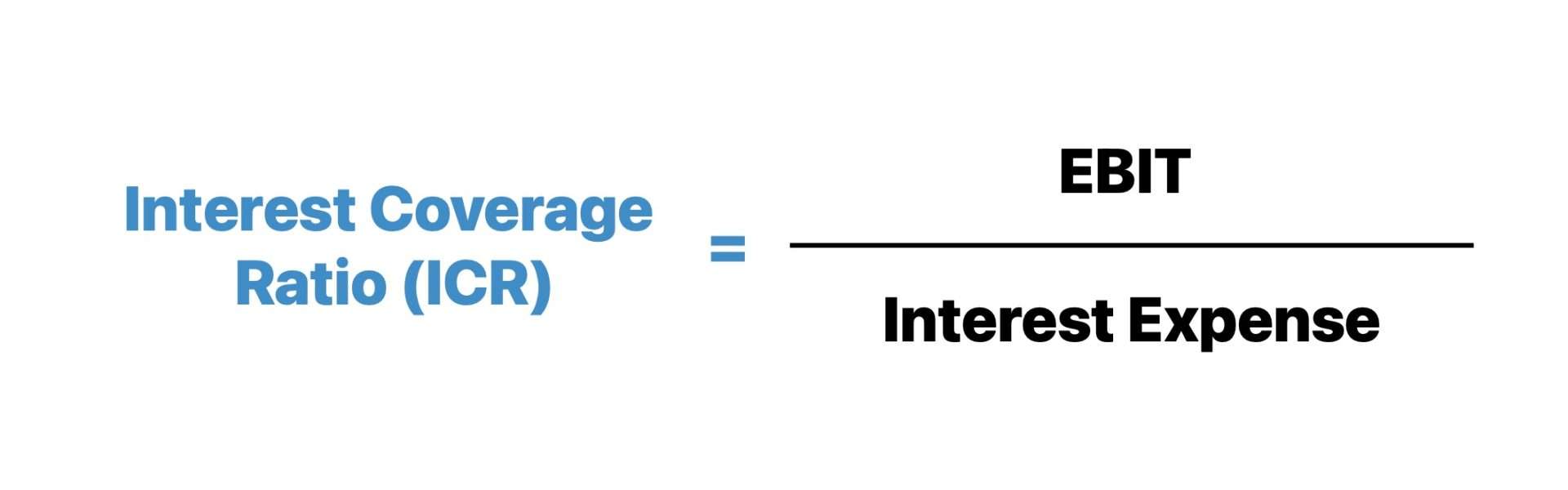

The basic formula for the interest coverage ratio is straightforward:

Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

Let’s break down each component:

- Earnings Before Interest and Taxes (EBIT): This represents a company’s profit before accounting for interest expenses and taxes. It’s often found on the income statement.

- Interest Expense: This is the total amount of interest a company pays on its debt during a specific period, also found on the income statement.

Step-by-Step Calculation

- Locate EBIT: Find the Earnings Before Interest and Taxes on the company’s income statement. This might also be labeled as operating income.

- Locate Interest Expense: Find the Interest Expense on the income statement. Be sure to include all interest-related expenses.

- Apply the Formula: Divide the EBIT by the Interest Expense.

- Interpret the Result: The resulting number indicates how many times the company can cover its interest obligations with its earnings.

Example Calculation

Let’s say a company has an EBIT of $5,000,000 and an Interest Expense of $500,000. The calculation would be:

Interest Coverage Ratio = $5,000,000 / $500,000 = 10

This means the company can cover its interest expense 10 times over with its earnings.

Interpreting the Interest Coverage Ratio

A higher ratio generally indicates a stronger financial position. Here’s a general guideline:

- Ratio of 2 or higher: Generally considered healthy, indicating the company can comfortably cover its interest obligations.

- Ratio between 1 and 2: May indicate some financial strain, requiring closer monitoring.

- Ratio below 1: Indicates the company is struggling to cover its interest expenses and may be at risk of default.

Factors Affecting the Interest Coverage Ratio

Several factors can influence a company’s interest coverage ratio, including:

- Changes in Revenue: Increased revenue generally leads to higher EBIT, improving the ratio.

- Changes in Expenses: Higher operating expenses can decrease EBIT, negatively impacting the ratio.

- Changes in Debt Levels: Increased debt leads to higher interest expenses, lowering the ratio.

- Changes in Interest Rates: Higher interest rates on existing debt increase interest expenses, lowering the ratio.

Limitations of the Interest Coverage Ratio

While the interest coverage ratio is a useful metric, it’s important to consider its limitations:

- It’s a snapshot in time: The ratio reflects a company’s financial position at a specific point in time and may not be indicative of future performance.

- It doesn’t consider all obligations: It only focuses on interest expense and doesn’t account for other debt obligations, such as principal payments;

- EBIT can be manipulated: Companies can sometimes manipulate their EBIT through accounting practices, potentially distorting the ratio.

Calculating the interest coverage ratio is a fundamental step in assessing a company’s financial health and ability to manage its debt. However, it’s crucial to remember that this ratio is just one piece of the puzzle. A comprehensive financial analysis should also consider other factors, such as cash flow, debt-to-equity ratio, and industry trends, to gain a more complete understanding of a company’s financial stability. By understanding and applying this ratio, investors and stakeholders can make more informed decisions and better assess the risks associated with investing in or lending to a particular company.

Beyond the Numbers: A Holistic View

Imagine the interest coverage ratio as a lone lighthouse on a stormy sea. It throws a beam of light, illuminating a specific danger – the risk of drowning in debt. But the sea is vast, and other perils lurk beneath the surface. To truly navigate the treacherous waters of corporate finance, we need a more comprehensive map.

Consider the story of “Innovate Corp,” a tech startup with a groundbreaking idea but a mountain of debt. Their interest coverage ratio hovers precariously around 1.2, flashing warning signals. A superficial analysis might paint a grim picture. However, delve deeper, and you discover that Innovate Corp holds several patents with immense future value, currently untapped. They’re also in talks with a major industry player for a lucrative licensing agreement. The lighthouse warns of immediate danger, but the long-term trajectory suggests a brighter horizon. This illustrates the importance of considering qualitative factors, such as innovation, market position, and management expertise, which are not captured by the ratio alone.

The Art of Scenario Planning

Instead of relying solely on a single ratio based on past performance, visionary analysts employ scenario planning. What happens to the interest coverage ratio if:

- A major competitor launches a similar product?

- Interest rates rise unexpectedly?

- A key supplier goes bankrupt?

By modeling these potential outcomes, we can assess a company’s resilience under different conditions and identify potential vulnerabilities. This approach transforms the interest coverage ratio from a static indicator into a dynamic tool for risk management.

The Symphony of Financial Metrics

The interest coverage ratio doesn’t sing a solo. It’s part of a complex orchestra of financial metrics, each playing a crucial role in the overall harmony. Consider how it interacts with:

| Metric | How it complements the Interest Coverage Ratio |

|---|---|

| Debt-to-Equity Ratio | Provides context for the overall level of debt relative to equity, indicating the company’s financial leverage. A high debt-to-equity ratio alongside a low interest coverage ratio is a double red flag. |

| Cash Flow Statement | Examines the company’s ability to generate cash, which is ultimately what’s used to pay down debt. A healthy cash flow can compensate for a slightly lower interest coverage ratio. |

| Working Capital Management | Efficient management of current assets and liabilities can free up cash to cover interest payments. |

By analyzing these metrics in conjunction with the interest coverage ratio, we gain a richer, more nuanced understanding of a company’s financial health.

A Glimpse into the Future: AI and Predictive Analytics

The future of financial analysis is intertwined with the rise of artificial intelligence and predictive analytics. Imagine AI algorithms that can sift through vast amounts of data, including news articles, social media sentiment, and economic indicators, to predict changes in a company’s interest coverage ratio. These algorithms can identify subtle patterns and correlations that humans might miss, providing early warnings of potential financial distress. In this era, the interest coverage ratio will evolve from a reactive indicator to a proactive tool for anticipating and mitigating risks. The analysis of the interest coverage ratio, therefore, is not just about numbers but about understanding the narrative behind them, the potential risks and opportunities, and the long-term vision of the company.