Paying off a mortgage is a significant financial goal for many homeowners. One strategy that often gets discussed is making biweekly mortgage payments. But what does that actually mean, and can you pay your mortgage biweekly? This article will explore the advantages of biweekly mortgage payments and how to determine if it’s a viable option for your situation. Understanding the nuances of this payment method can potentially save you money and reduce the overall term of your loan.

What Are Biweekly Mortgage Payments?

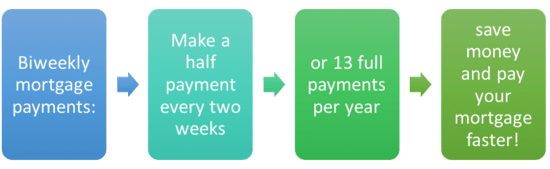

Biweekly mortgage payments involve making half of your regular monthly mortgage payment every two weeks. This seemingly small change can have a big impact over the life of your loan.

The core idea behind biweekly payments revolves around making the equivalent of 13 monthly payments each year instead of 12. Here’s the math:

- 52 weeks in a year / 2 weeks = 26 biweekly payments

- 26 biweekly payments * (1/2 monthly payment) = 13 monthly payments

The Advantages of Biweekly Mortgage Payments

Switching to a biweekly payment schedule offers several potential benefits for homeowners. These benefits can include faster loan repayment and reduced interest costs.

Accelerated Loan Repayment

Because you’re effectively making one extra monthly payment each year, you’ll pay off your mortgage faster. This reduces the time it takes to become mortgage-free.

Reduced Interest Costs

Paying your mortgage off faster means you’re paying less interest over the life of the loan. The savings can be substantial, potentially thousands of dollars.

Building Equity Faster

With each biweekly payment, more money goes towards your principal. This allows you to build equity in your home faster than with monthly payments.

How to Implement Biweekly Mortgage Payments

There are a few ways to implement a biweekly mortgage payment plan. Understanding your options is key to choosing the best approach for your needs.

- Directly Through Your Lender: Some lenders offer official biweekly mortgage payment programs. Contact your lender to inquire about availability and associated fees.

- Self-Managed Approach: You can manually make half of your mortgage payment every two weeks. Be sure to make a full extra payment at some point during the year.

- Third-Party Services: Several companies specialize in managing biweekly mortgage payments. Research reputable options and understand their fees before enrolling.

Things to Consider Before Switching

Before jumping into a biweekly payment plan, consider the following factors. These considerations can help you avoid potential pitfalls and ensure the plan is right for you.

| Consideration | Description |

|---|---|

| Lender Fees | Some lenders charge fees for setting up or maintaining a biweekly payment program. |

| Cash Flow | Ensure you have sufficient cash flow to comfortably make biweekly payments without straining your budget. |

| Prepayment Penalties | Check your mortgage agreement for prepayment penalties. While less common now, some mortgages may have them. |

FAQ: Biweekly Mortgage Payments

Here are some frequently asked questions about biweekly mortgage payments:

Will my lender automatically apply the extra payment to the principal?

It’s crucial to confirm with your lender that the extra payment will be applied directly to the principal balance. Otherwise, it might just be held in escrow and applied to the next month’s payment.

Is it better to make one large annual payment instead of biweekly payments?

The effect is essentially the same. Making one large principal payment or consistent biweekly payments will reduce your principal balance and interest paid over time.

What if I miss a biweekly payment?

If you miss a biweekly payment, contact your lender immediately to understand the consequences and arrange a solution. Consistent payments are key to realizing the benefits of this strategy.

Ultimately, deciding whether or not to switch to biweekly mortgage payments depends on your individual financial situation and goals. Carefully evaluate your budget, research your options, and consult with a financial advisor if needed. The potential benefits of accelerated loan repayment and reduced interest costs can make biweekly payments an attractive option for many homeowners. By understanding the mechanics and considering the potential drawbacks, you can make an informed decision that aligns with your long-term financial well-being. This strategy could be the key to owning your home sooner and saving a significant amount of money in the process. Remember to consult with your lender before making any changes to your mortgage payment schedule.

Are Biweekly Payments Right for You?

Considering all this, are biweekly mortgage payments the right choice for you? Let’s delve a bit deeper.

Do You Have a Stable Income?

If your income fluctuates significantly, can you reliably make half of your mortgage payment every two weeks? What happens if unexpected expenses arise – will you still be able to keep up with the accelerated payment schedule?

Have You Calculated the Potential Savings?

Have you used a mortgage calculator to estimate the exact amount of interest you could save and how much faster you could pay off your loan with biweekly payments? Are these savings significant enough to justify the effort and potential fees associated with the payment plan?

Are You Disciplined Enough to Manage Your Own Biweekly Payments?

If you opt for the self-managed approach, will you consistently remember to make the extra payments throughout the year? Will you be tempted to skip a payment if other expenses arise? Do you have a system in place to track your payments and ensure the extra amounts are applied to the principal?

Have You Explored Other Debt Reduction Strategies?

Are biweekly mortgage payments the most effective way for you to accelerate debt repayment? Could you achieve similar results by making occasional extra principal payments when you have surplus funds? Are there other higher-interest debts, such as credit cards, that you should prioritize paying off first?

Could You Invest the Extra Funds Instead?

Instead of accelerating your mortgage repayment, could you potentially earn a higher return by investing the extra funds? Have you considered the opportunity cost of locking your money into your mortgage versus investing in stocks, bonds, or other assets? Does your risk tolerance align better with paying down debt or pursuing investment opportunities?

Alternatives to Biweekly Payments

Perhaps biweekly payments aren’t the perfect fit. What other options do you have to save on your mortgage?

- Making Extra Principal Payments: Instead of committing to a rigid biweekly schedule, could you make extra principal payments whenever you have the funds available? This offers more flexibility and allows you to adapt to changing financial circumstances.

- Refinancing Your Mortgage: Could you potentially lower your interest rate and shorten your loan term by refinancing your mortgage? Is your credit score and financial situation strong enough to qualify for a better loan?

- Budgeting and Savings: Could you identify areas in your budget where you can cut expenses and allocate those savings toward your mortgage? Are you maximizing your savings potential through other financial strategies?

The decision to adopt a biweekly mortgage payment plan is a personal one, dependent on individual circumstances and financial goals. Have you thoroughly considered all the potential benefits and drawbacks? Are you prepared to commit to the consistent payments required for success? Before making any changes, consult with your lender and a financial advisor to ensure this strategy aligns with your overall financial plan. Weigh the advantages against other debt reduction and investment options to make the most informed choice for your future. Remember, the goal is to achieve financial security and homeownership in a way that best suits your unique situation. Take your time, do your research, and choose the path that empowers you to reach your financial aspirations.