In today’s fast-paced world, convenience is king, and that extends to important decisions like purchasing car insurance․ Securing the right car insurance is crucial for protecting your financial well-being in case of accidents or unforeseen circumstances․ But where should you buy it? The traditional route of purchasing car insurance through a car dealer is becoming increasingly outdated, especially when compared to the ease and potential benefits of buying car insurance online․ Let’s explore the top five reasons why opting for online car insurance might be the smarter choice for you․

1․ Unparalleled Convenience and Speed

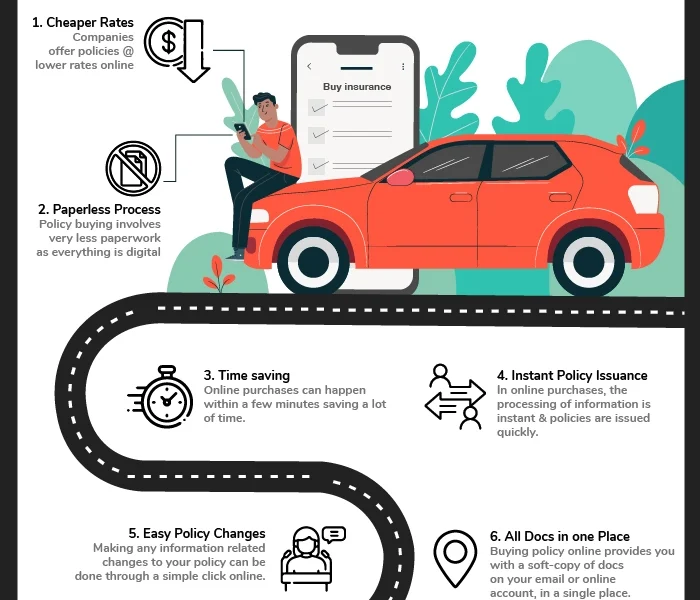

Forget spending hours at the dealership, filling out paperwork and waiting for quotes․ Buying car insurance online offers unmatched convenience․ You can get quotes from multiple insurers in minutes, all from the comfort of your own home․ No more stressful negotiations or feeling pressured to make a quick decision․ The online process streamlines the entire experience, allowing you to compare policies and coverage options at your own pace․

2․ Wider Range of Options and Customization

Dealers typically partner with a limited number of insurance providers, restricting your choices․ Online platforms provide access to a vast network of insurance companies, offering a wider range of policies and coverage options․ This allows you to find a policy that perfectly suits your specific needs and budget․ You can customize your coverage, deductibles, and limits to create a tailored plan that provides the best protection for you and your vehicle․

3․ Competitive Pricing and Potential Savings

Online insurance companies often offer more competitive prices than dealerships․ This is because online insurers have lower overhead costs and can pass those savings on to their customers․ You can easily compare quotes from multiple providers and identify the most affordable option․ Furthermore, you might be eligible for online-only discounts or promotions, further reducing your premiums․

4․ Increased Transparency and Information

Online insurance platforms provide detailed information about policies, coverage options, and terms and conditions․ You can easily access policy documents, FAQs, and customer reviews, empowering you to make informed decisions․ The transparency offered by online insurers allows you to understand exactly what you’re paying for and avoid any hidden fees or surprises․

5․ No Pressure Sales Tactics

Dealerships are often focused on selling cars, and insurance might be an afterthought․ This can lead to high-pressure sales tactics and a lack of focus on your individual needs․ Buying car insurance online removes that pressure and allows you to make a decision based on your own research and preferences․ You have the freedom to compare quotes, read reviews, and ask questions without feeling obligated to purchase anything․

Comparing Online vs; Dealer Insurance

| Feature | Online Insurance | Dealer Insurance |

|---|---|---|

| Convenience | High | Low |

| Range of Options | Wide | Limited |

| Pricing | Competitive | Often Higher |

| Transparency | High | Lower |

| Pressure Sales | None | Present |