In today’s dynamic business environment, managing finances efficiently is crucial for success. Corporate credit cards offer a powerful tool to streamline expenses, track spending, and empower employees. From simplifying travel arrangements to providing valuable data insights, these cards can significantly benefit both the company and its workforce. Understanding the myriad advantages of corporate credit cards can transform your financial management strategy.

Enhanced Expense Management

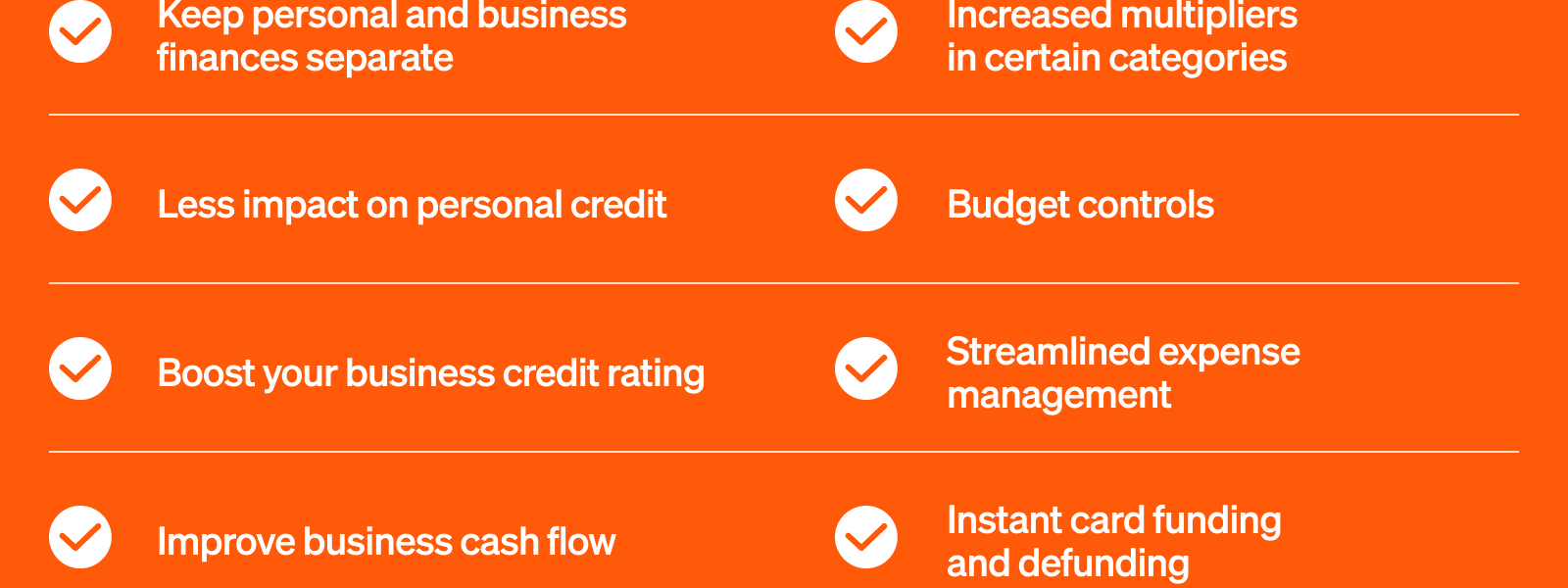

One of the primary benefits of implementing corporate credit cards is the improved expense management they offer. Traditional methods of expense tracking, such as manual spreadsheets and paper receipts, are often time-consuming and prone to errors. Corporate cards automate this process, providing a centralized system for monitoring spending across the organization.

- Real-time Tracking: Monitor employee spending in real-time, ensuring adherence to budget guidelines.

- Simplified Reporting: Generate comprehensive expense reports with ease, saving time and resources.

- Fraud Prevention: Detect and prevent fraudulent activity with advanced security features.

Empowering Employees

Providing employees with corporate credit cards can significantly enhance their ability to perform their jobs effectively. Imagine a scenario where an employee needs to book a last-minute flight for a crucial client meeting. Instead of navigating complex reimbursement processes, they can simply use their corporate card, streamlining the process and saving valuable time.

Benefits for Employees:

- Convenience: Employees can make necessary purchases without using personal funds.

- Efficiency: Streamlined expense reporting reduces administrative burden.

- Flexibility: Employees can handle unexpected expenses while traveling or working remotely.

Improved Cash Flow Management

Corporate credit cards can also contribute to improved cash flow management. By utilizing the grace period offered by the card, businesses can delay payments and optimize their working capital. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that may face cash flow constraints.

Data Insights and Analytics

Many corporate credit card providers offer advanced data analytics tools that provide valuable insights into spending patterns. This data can be used to identify areas where costs can be reduced and to optimize spending strategies. For example, analyzing spending data can reveal opportunities to negotiate better rates with suppliers or to consolidate travel arrangements.

Building Credit History

Responsible use of corporate credit cards can contribute to building a positive credit history for the business. This can be particularly important for startups and SMEs that may need to access financing in the future. A strong credit history can improve the company’s access to credit and potentially lower borrowing costs.

Rewards and Incentives

Many corporate credit cards offer rewards programs that can provide valuable incentives for employees and the company as a whole. These rewards can include cash back, travel points, or discounts on business-related expenses. Choosing a card with a rewards program that aligns with the company’s spending habits can significantly enhance the overall value of the card. Thinking strategically about how to redeem these rewards can further maximize the benefits. Therefore, careful evaluation of available options is paramount. Finally, corporate credit cards offer yet another way to improve employee and company finances.