Navigating the complex world of insurance can feel overwhelming, especially when faced with similar-sounding options. Many people mistakenly believe that all health-related insurance policies offer the same coverage, leading to potential gaps in their financial safety net during times of serious illness. Understanding the nuances between different types of policies, like Terminal and Critical Illness Insurance, is crucial for making informed decisions that align with your individual needs and financial circumstances. This article will delve into the core differences between these two insurance products, empowering you to choose the right policy for your unique situation and avoid making a costly mistake. Knowing which policy is best suited for you hinges on understanding what each covers.

Terminal Illness Insurance: Providing Support in the Final Stages

Terminal Illness Insurance is designed to provide a lump-sum payment if you are diagnosed with a terminal illness and have a limited life expectancy, typically 12 months or less. This payout can be used to cover a variety of expenses, including:

- Medical bills not covered by your primary health insurance

- Outstanding debts

- Funeral expenses

- Living expenses for your family

- Fulfilling end-of-life wishes

Essentially, Terminal Illness Insurance aims to alleviate the financial burden on your loved ones during a difficult time and allow you to focus on your comfort and well-being. It focuses on providing support and financial stability during the final stages of life.

Critical Illness Insurance: Covering a Wider Range of Serious Conditions

Critical Illness Insurance, on the other hand, provides a lump-sum payment if you are diagnosed with a specific critical illness covered by the policy. These illnesses typically include:

- Cancer

- Heart attack

- Stroke

- Kidney failure

- Multiple sclerosis

- Organ transplant

The key difference here is that Critical Illness Insurance is not necessarily tied to a terminal prognosis. It provides financial assistance to help you manage the costs associated with treatment, recovery, and lifestyle adjustments following a diagnosis of a covered critical illness. The payout can be used as you see fit, offering financial flexibility during a challenging period.

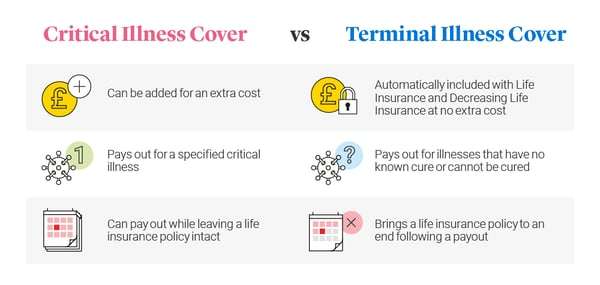

Key Differences Summarized

| Feature | Terminal Illness Insurance | Critical Illness Insurance |

|---|---|---|

| Trigger for Payout | Diagnosis of a terminal illness with a limited life expectancy (usually 12 months or less) | Diagnosis of a specific critical illness covered by the policy |

| Focus | Providing financial support during the final stages of life | Providing financial assistance for treatment, recovery, and lifestyle adjustments following a critical illness diagnosis |

| Life Expectancy Requirement | Typically requires a life expectancy of 12 months or less | No life expectancy requirement |

Choosing between Terminal and Critical Illness Insurance requires careful consideration of your individual circumstances, health history, and financial goals. Understanding the nuances of each policy is paramount to ensuring you have the right coverage in place when you need it most. Therefore, consult with a qualified insurance advisor to determine the best fit for your needs.

Beyond the core differences, consider the specific terms and conditions of each policy. Pay close attention to the list of covered critical illnesses in a Critical Illness Insurance policy. Policies can vary significantly in the number and type of illnesses they cover. For example, some policies may cover certain types of cancer but not others. Similarly, the severity of the condition may also play a role in whether or not a claim is approved. Read the fine print carefully to understand the exclusions and limitations.

Assessing Your Individual Needs

When deciding which type of insurance is right for you, ask yourself the following questions:

- What are my biggest health concerns based on my family history and lifestyle?

- What financial resources would I need if I were diagnosed with a serious illness?

- How comfortable am I with the risk of not having coverage for a specific type of illness?

- What is my budget for insurance premiums?

Answering these questions honestly will help you prioritize your needs and identify the type of coverage that best aligns with your personal circumstances. Remember, insurance is about mitigating risk, and the right policy can provide peace of mind knowing that you have a financial safety net in place.

Don’t Go It Alone: Seek Professional Advice

The world of insurance can be complex, and navigating it alone can be daunting. Consulting with a qualified insurance advisor is highly recommended. An advisor can help you understand the different policy options available, assess your individual needs, and recommend the most appropriate coverage for your situation. They can also answer any questions you may have and guide you through the application process. A good advisor will act as your advocate, ensuring that you understand your policy and that your needs are met.

Ultimately, the decision of whether to choose Terminal Illness Insurance, Critical Illness Insurance, or a combination of both is a personal one. However, by understanding the key differences between these policies, assessing your individual needs, and seeking professional advice, you can make an informed decision that protects your financial well-being and provides peace of mind for yourself and your loved ones. The goal is to be prepared and make the best possible choice based on your specific situation and that means carefully considering which type of Terminal and Critical Illness Insurance is right for you.