The world of business is a complex tapestry woven with diverse industries, each presenting its own unique challenges and opportunities. Among these challenges, navigating taxation and compliance stands out as a critical area demanding meticulous attention. Understanding the nuances of Navigating Taxation And Compliance In Different Business Sectors is not merely about adhering to legal requirements; it’s about building a sustainable and ethically sound business. The complexities can seem daunting, but with proper planning and a strategic approach, businesses can effectively manage their tax obligations and ensure full compliance, leading to long-term success.

Understanding Sector-Specific Tax Landscapes

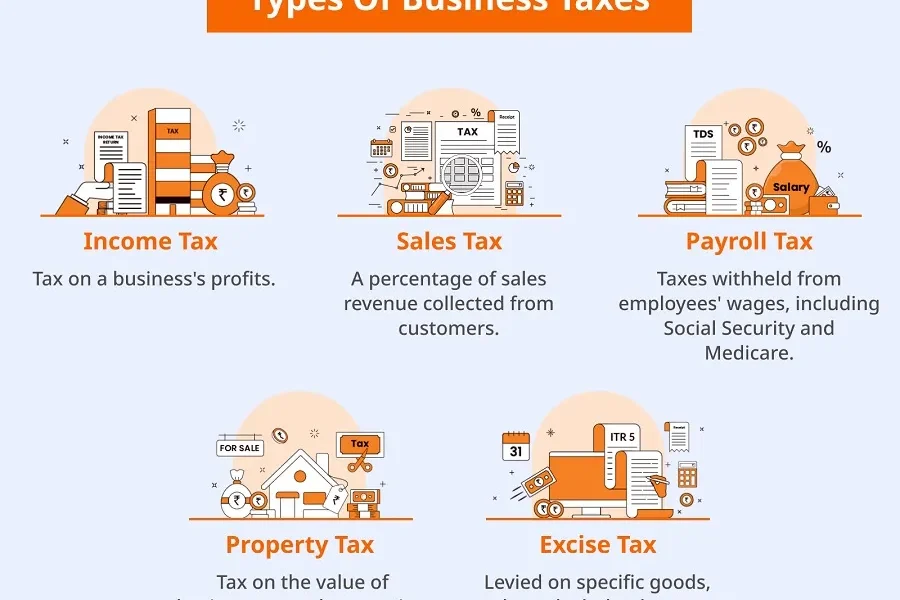

Different business sectors face vastly different taxation rules and compliance requirements. What applies to a tech startup might be completely irrelevant to a manufacturing company or a retail chain. This section delves into some key considerations:

- Industry Classification: Correctly identifying your business’s industry classification is crucial. This classification determines the specific tax codes and regulations that apply.

- Tax Incentives & Credits: Many governments offer industry-specific tax incentives and credits to encourage growth in particular sectors. Understanding and leveraging these incentives can significantly reduce your tax burden.

- Compliance Requirements: Each sector has its own set of compliance requirements related to reporting, record-keeping, and regulatory approvals.

Key Considerations for Specific Sectors

Manufacturing

Manufacturing businesses often deal with complex inventory valuation methods, depreciation of heavy machinery, and potential environmental taxes. Proper planning and accurate record-keeping are paramount.

Technology

The technology sector faces unique challenges related to intellectual property, research and development (R&D) tax credits, and international tax considerations if operating globally.

Retail

Retail businesses need to manage sales tax collection and remittance accurately. They also need to be aware of state and local taxes that may vary depending on location.

Service Industries

Service industries must understand how revenue recognition rules apply to their specific services, and ensure proper classification of employees vs. independent contractors.

Strategies for Effective Tax Compliance

Regardless of the sector, implementing robust strategies for tax compliance is essential. Here are some key steps:

- Maintain Accurate Records: Detailed and organized financial records are the foundation of effective tax compliance.

- Stay Updated on Tax Law Changes: Tax laws are constantly evolving. Stay informed about changes that may impact your business.

- Seek Professional Advice: Consulting with a qualified tax professional can provide valuable guidance and ensure you are meeting all your obligations.

- Implement Internal Controls: Strong internal controls can help prevent errors and ensure accuracy in your tax filings.

Effective Navigating Taxation And Compliance In Different Business Sectors requires a proactive and informed approach. By understanding the specific challenges and opportunities within your industry, and by implementing robust compliance strategies, you can minimize your tax liabilities, avoid penalties, and build a financially sound business.

Leveraging Technology for Enhanced Compliance

In today’s digital age, technology offers powerful tools to streamline tax compliance processes. Think of it as equipping yourself with a superior navigation system in the complex sea of tax regulations. Consider these technological advancements:

- Tax Software: Robust tax software solutions can automate many aspects of tax preparation, from calculating deductions to generating accurate reports. Choosing the right software that caters to your specific industry needs is crucial.

- Cloud-Based Accounting: Cloud accounting platforms offer real-time visibility into your financial data, facilitating better decision-making and simplifying audits. They also enhance collaboration between your team and external tax advisors.

- Data Analytics: Data analytics tools can help you identify potential tax risks and opportunities by analyzing large datasets. This proactive approach allows you to address issues before they become major problems.

Building a Culture of Compliance

Compliance isn’t just about ticking boxes; it’s about fostering a culture of integrity and ethical behavior within your organization. This starts from the top down. Leaders must champion compliance and set a clear example for employees to follow. Consider these strategies:

- Compliance Training: Provide regular training to employees on tax laws and regulations relevant to their roles. This ensures they understand their responsibilities and the importance of compliance.

- Whistleblower Policies: Implement a confidential whistleblower policy to encourage employees to report potential violations without fear of retaliation. This can help identify and address issues early on.

- Regular Audits: Conduct internal audits regularly to assess your compliance processes and identify areas for improvement. Treat these audits as learning opportunities, not just fault-finding exercises.

The Future of Taxation and Compliance

The landscape of taxation and compliance is constantly evolving, driven by globalization, technological advancements, and changing regulatory priorities. Staying ahead of the curve requires a forward-thinking approach. We see trends towards:

- Increased Automation: Expect even greater automation in tax compliance processes, driven by artificial intelligence (AI) and machine learning (ML).

- Real-Time Reporting: Governments are increasingly moving towards real-time reporting requirements, demanding businesses to provide tax data more frequently and in a more granular format.

- Focus on Transparency: There is a growing emphasis on transparency in tax matters, with governments pushing for greater disclosure of tax information by multinational corporations.

As you continue Navigating Taxation And Compliance In Different Business Sectors, remember that adaptability is key. Embrace technology, foster a culture of compliance, and stay informed about the evolving regulatory landscape. By doing so, you can ensure your business remains compliant and thriving in an increasingly complex world.

Practical Steps for Sector-Specific Tax Management

Alright, let’s get down to brass tacks. Theory is good, but practical application is where the real value lies. Here’s how to take those high-level concepts and turn them into actionable steps within your business:

Step 1: Conduct a Thorough Tax Risk Assessment

Every business, regardless of sector, should start with a comprehensive tax risk assessment. This isn’t just a one-time thing; it’s a continuous process. Think of it like this: you’re scouting the terrain before embarking on a journey. Key areas to consider include:

- Identifying potential areas of non-compliance (e.g., incorrect sales tax collection, misclassification of employees).

- Assessing the likelihood and impact of each risk.

- Developing mitigation strategies to minimize those risks.

Step 2: Develop a Tailored Tax Compliance Plan

Once you’ve identified your risks, it’s time to create a customized tax compliance plan. This plan should outline the specific steps your business will take to meet its tax obligations. This is your roadmap, folks. It needs to be detailed and actionable. Consider including:

- A calendar of key tax deadlines (e.g., quarterly estimated tax payments, annual income tax returns).

- Defined roles and responsibilities for tax-related tasks.

- Standard operating procedures for collecting, recording, and reporting financial data.

Step 3: Implement Robust Internal Controls

A compliance plan is only as good as the internal controls that support it. Think of internal controls as the guardrails that keep your business on track. These controls should be designed to prevent errors, detect irregularities, and ensure the accuracy of your financial data. Examples include:

- Segregation of duties (e.g., the person who approves invoices should not be the same person who makes payments).

- Regular reconciliations of bank accounts and other financial records.

- Authorization procedures for significant transactions.

Step 4: Stay Proactive with Tax Planning

Tax compliance isn’t just about meeting deadlines and avoiding penalties. It’s also about maximizing your tax savings through proactive tax planning. This involves looking ahead and identifying opportunities to minimize your tax burden within the bounds of the law. Think of it as playing chess, not checkers. Consider these strategies:

- Taking advantage of available deductions and credits (e.g., R&D tax credits, depreciation deductions).

- Structuring your business in a tax-efficient manner.

- Deferring income to future years, where appropriate.

Step 5: Continuous Monitoring and Improvement

Tax compliance is an ongoing process, not a one-time event. You need to continuously monitor your compliance efforts and identify areas for improvement. Think of it as a feedback loop. Regularly review your tax risk assessment, compliance plan, and internal controls to ensure they remain effective. Consider:

- Performing regular internal audits to identify potential weaknesses.

- Staying updated on changes in tax laws and regulations.

- Seeking feedback from your tax advisors and employees.

Examples Across Industries: A Quick Look

Let’s solidify this with a few quick examples across different industries. I want you to see how these principles translate into real-world scenarios.

Manufacturing: Inventory Management and Depreciation

Manufacturers need to pay close attention to inventory valuation methods (FIFO, LIFO, weighted average) as they can significantly impact taxable income. Don’t forget accelerated depreciation methods for machinery and equipment, but ensure you’re compliant with IRS rules.

Technology: R&D Credits and Software Revenue Recognition

Tech companies should rigorously track R&D expenses to maximize the R&D tax credit. Understanding complex software revenue recognition rules (ASC 606) is also critical, especially for SaaS businesses.

Retail: Sales Tax Nexus and Multi-State Compliance

Retailers, especially those with online sales, must understand sales tax nexus rules. This determines where they’re required to collect and remit sales tax. Multi-state compliance can be a real headache, so invest in good software or outsource to a specialist.

Service Industries: Employee vs. Contractor and Expense Reimbursements

Service businesses need to be meticulous about classifying workers as employees or independent contractors. The IRS has strict rules, and misclassification can lead to significant penalties. Also, ensure expense reimbursements are properly documented and comply with accountable plan rules.