In today’s complex world, managing personal finances can feel like navigating a labyrinth. Keeping track of income, expenses, investments, and debts often requires juggling multiple spreadsheets, apps, and accounts. A comprehensive financial dashboard offers a centralized solution, providing a clear and concise overview of your financial health. Utilizing a well-designed financial dashboard empowers you to make informed decisions, track progress towards your goals, and ultimately achieve financial freedom.

Understanding the Power of a Financial Dashboard

A financial dashboard is more than just a collection of numbers; it’s a powerful tool that transforms raw data into actionable insights. By consolidating your financial information into a single, easily accessible platform, you can gain a holistic understanding of your current financial situation. This clarity allows you to identify areas where you can improve your spending habits, optimize your investments, and accelerate your progress towards your financial goals.

Key Components of an Effective Dashboard

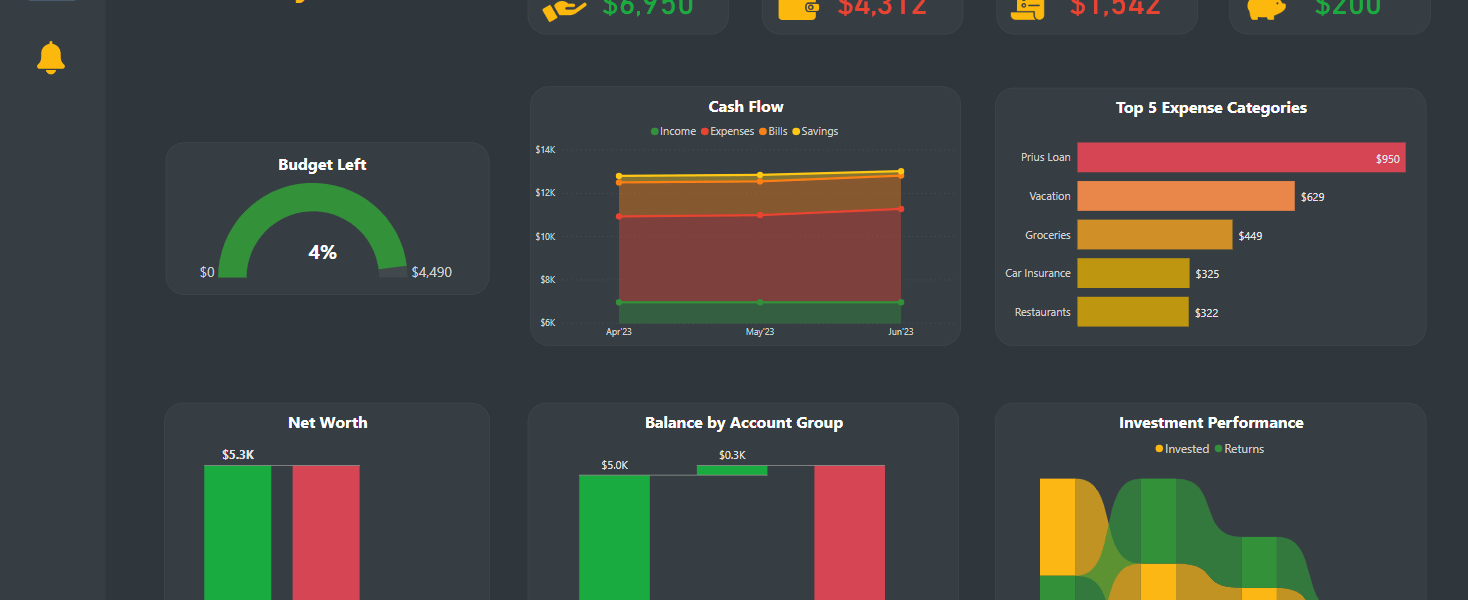

- Income Tracking: Monitor your income streams, including salary, investments, and side hustles.

- Expense Tracking: Categorize and analyze your spending habits to identify areas where you can cut back.

- Net Worth Calculation: Track your assets (e.g., savings, investments, property) and liabilities (e.g., loans, credit card debt) to determine your net worth.

- Budgeting Tools: Create and manage budgets to stay on track with your financial goals;

- Investment Performance: Monitor the performance of your investments and make adjustments as needed.

- Debt Management: Track your debts and develop a plan to pay them off.

Benefits of Using a Financial Dashboard

The advantages of implementing a financial dashboard are numerous and far-reaching. Beyond simply organizing your financial data, a well-designed dashboard can have a profound impact on your overall financial well-being.

- Improved Financial Awareness: Gain a clear understanding of where your money is going and coming from.

- Data-Driven Decision Making: Make informed financial decisions based on accurate and up-to-date data.

- Enhanced Budgeting: Create and stick to a budget that aligns with your financial goals.

- Debt Reduction: Develop a plan to pay off debt and track your progress.

- Investment Optimization: Monitor your investment performance and make adjustments as needed.

- Goal Tracking: Track your progress towards your financial goals and stay motivated.

Choosing the Right Financial Dashboard for You

With a plethora of financial dashboards available, selecting the right one can feel overwhelming. Consider your specific needs and preferences when making your decision. Look for a dashboard that is user-friendly, customizable, and integrates with your existing financial accounts. Some options are software based, other options are online and subscription based. Comparing your options before implementing is key!

Taking control of your finances starts with understanding them, and a financial dashboard can be the key to unlocking that understanding.

Here is the continuation of the text in an advisory style, incorporating HTML tags:

Implementing and Maintaining Your Financial Dashboard

Once you’ve chosen the ideal financial dashboard, the next step is implementation. This involves connecting your various financial accounts, such as bank accounts, credit cards, and investment portfolios, to the platform. Be sure to review the privacy and security policies of the dashboard provider to ensure your data is protected. After your accounts are linked, take some time to categorize your transactions and customize the dashboard to display the information that is most relevant to you. Don’t be afraid to experiment with different views and features to find what works best for your individual needs.

Tips for Success

- Start Small: Don’t try to do everything at once. Begin by tracking your income and expenses, and then gradually add more features as you become more comfortable.

- Be Consistent: Regularly update your dashboard to ensure the data is accurate and up-to-date. This could mean logging in weekly or even daily to categorize transactions and monitor your progress.

- Review Regularly: Schedule time each month to review your financial dashboard and analyze your financial performance. Look for trends, identify areas for improvement, and adjust your strategies as needed.

- Set Realistic Goals: Use your dashboard to set achievable financial goals and track your progress towards them. This could include saving for a down payment on a house, paying off debt, or investing for retirement.

- Seek Professional Advice: If you’re struggling to understand your financial data or make informed decisions, consider seeking advice from a qualified financial advisor.

Beyond the Basics: Advanced Dashboard Features

Many financial dashboards offer advanced features that can further enhance your financial management. These features may include goal-setting tools, retirement planning calculators, and investment analysis tools. Some dashboards even provide personalized recommendations based on your financial situation and goals. Explore these advanced features to see how they can help you take your financial planning to the next level.

Comparative Table of Dashboard Features

| Feature | Dashboard Option A | Dashboard Option B | Dashboard Option C |

|---|---|---|---|

| Budgeting Tools | Basic | Advanced | Customizable |

| Investment Tracking | Limited | Comprehensive | Real-time updates |

| Debt Management | Simple tracking | Debt payoff calculator | Personalized plan |

| Goal Setting | Basic | Visual progress | Automated adjustments |

By embracing a proactive approach to financial management and leveraging the power of a financial dashboard, you can gain greater control over your financial future. Regularly updating and analyzing the information within your dashboard is crucial for long-term financial success.

Remember, a financial dashboard is not a magic bullet, but rather a powerful tool that requires active participation and consistent effort. It’s a journey of continuous learning and improvement. By regularly reviewing your data, setting realistic goals, and seeking professional advice when needed, you can harness the full potential of your dashboard to achieve your financial aspirations.

Overcoming Common Challenges

Using a financial dashboard isn’t always smooth sailing. You might encounter challenges such as difficulty categorizing transactions, dealing with inaccurate data, or feeling overwhelmed by the sheer volume of information. Don’t get discouraged! Here are some tips for overcoming these common hurdles:

- Transaction Categorization: Most dashboards allow you to create custom categories and rules to automate the categorization process. Take the time to set up these rules, and you’ll save yourself a lot of time and effort in the long run.

- Data Accuracy: Regularly reconcile your dashboard data with your actual bank and credit card statements. If you find any discrepancies, investigate them promptly and correct the errors.

- Overwhelm: Break down the data into smaller, more manageable chunks. Focus on one area at a time, such as your spending habits or your investment performance. You can also customize your dashboard to display only the information that is most relevant to you.

- Security Concerns: Always use strong passwords and enable two-factor authentication to protect your financial data. Be wary of phishing scams and never share your login credentials with anyone.

The Future of Financial Dashboards

Financial dashboards are constantly evolving, with new features and capabilities being added all the time. Artificial intelligence (AI) and machine learning (ML) are playing an increasingly important role in personal finance, enabling dashboards to provide personalized insights and recommendations based on your unique financial situation. Expect to see more integration with other financial tools and services, such as robo-advisors and tax preparation software. The future of financial dashboards is bright, offering even greater opportunities for individuals to take control of their financial lives.

Ultimately, the value of a financial dashboard lies in its ability to empower you to make informed decisions, achieve your financial goals, and build a secure financial future. Embrace this tool, use it wisely, and watch your financial confidence soar. Your journey to financial well-being starts with a single click!