Investing in gold has long been considered a safe haven during times of economic uncertainty. In 2020, with global events creating market volatility, many investors looked to gold as a means of preserving capital and potentially growing their portfolios. Understanding the various methods of investing in gold, and their respective risks and rewards, is crucial for making informed decisions. This guide will explore the common strategies for investing in gold during 2020, and provide insights into navigating this precious metal market.

Understanding Gold Investments

Before diving in, it’s important to understand the different forms that gold investments can take; Each option has unique characteristics that may appeal to different investors.

- Physical Gold: Includes gold bars, coins, and jewelry. Requires secure storage.

- Gold ETFs (Exchange-Traded Funds): Track the price of gold, offering liquidity and ease of trading.

- Gold Mining Stocks: Investing in companies that mine gold. Performance is correlated, but not directly tied to gold prices.

- Gold Futures Contracts: Agreements to buy or sell gold at a future date. More complex and riskier.

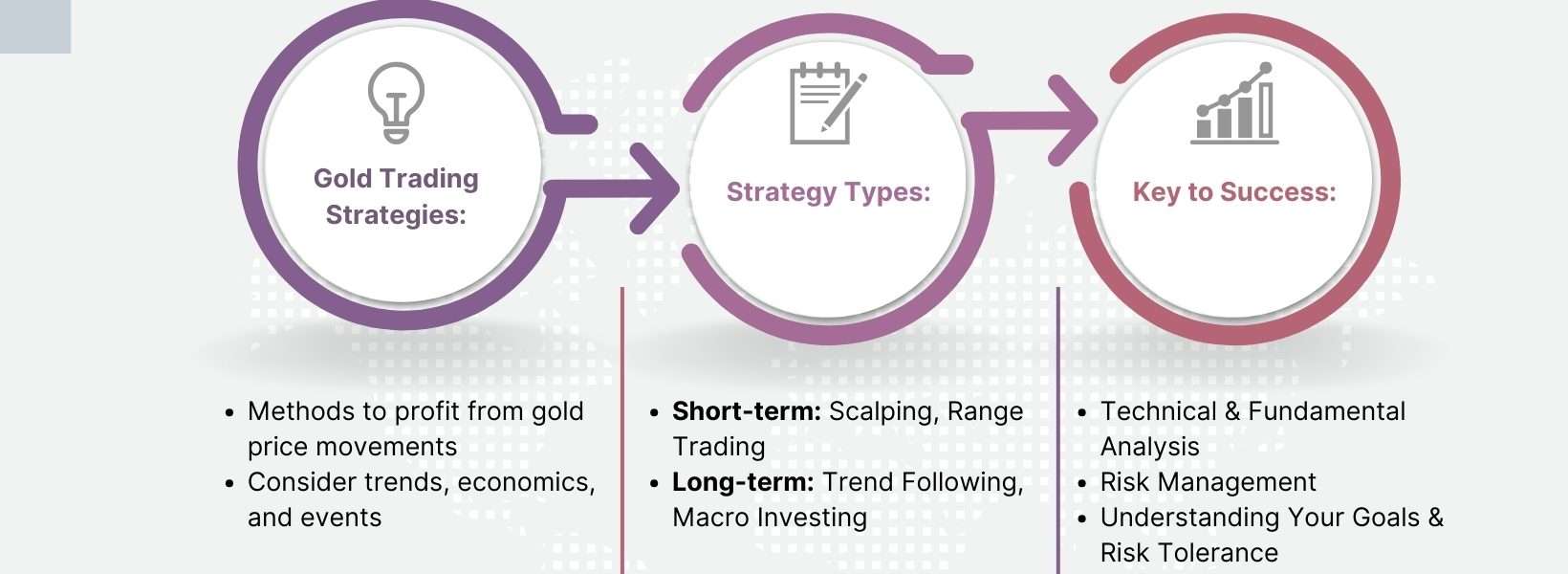

Strategies for Gold Investment in 2020

Several strategies were popular in 2020 for those looking to add gold to their investment portfolio. These varied based on risk tolerance and investment goals.

Diversification with Gold ETFs

Gold ETFs offer a simple and accessible way to diversify a portfolio. They track the price of gold and are traded on stock exchanges.

Fact: Gold ETFs often have low expense ratios, making them a cost-effective way to gain exposure to gold.

Investing in Gold Mining Stocks

Gold mining stocks can provide leverage to the price of gold, but they also carry company-specific risks.

| Factor | Gold ETFs | Gold Mining Stocks |

|---|---|---|

| Price Correlation | High | Moderate |

| Risk | Lower | Higher |

| Expense Ratios/Operating Costs | Low | Company-Specific Factors |

Buying Physical Gold: Considerations

Purchasing physical gold requires careful consideration of storage and security. Premiums over spot price also need to be factored in.

- Determine the amount of gold you want to purchase.

- Research reputable dealers and compare prices.

- Securely store your gold, either at home or in a vault.

FAQ ‒ Investing in Gold

Here are some frequently asked questions about investing in gold, especially relevant for 2020.

- Is gold a good investment during economic uncertainty? Gold is often seen as a safe haven asset, potentially holding its value or increasing during market downturns.

- What are the risks of investing in gold? Gold prices can be volatile, and physical gold requires secure storage. Gold mining stocks carry company-specific risks.

- How much of my portfolio should I allocate to gold? This depends on your risk tolerance and investment goals, but a common allocation is between 5% and 10%.

- Where can I buy gold? Gold can be purchased from reputable dealers, brokers, and online platforms.

Investing in gold has long been considered a safe haven during times of economic uncertainty. In 2020, with global events creating market volatility, many investors looked to gold as a means of preserving capital and potentially growing their portfolios. Understanding the various methods of investing in gold, and their respective risks and rewards, is crucial for making informed decisions. This guide will explore the common strategies for investing in gold during 2020, and provide insights into navigating this precious metal market.

Before diving in, it’s important to understand the different forms that gold investments can take. Each option has unique characteristics that may appeal to different investors.

- Physical Gold: Includes gold bars, coins, and jewelry. Requires secure storage.

- Gold ETFs (Exchange-Traded Funds): Track the price of gold, offering liquidity and ease of trading.

- Gold Mining Stocks: Investing in companies that mine gold. Performance is correlated, but not directly tied to gold prices.

- Gold Futures Contracts: Agreements to buy or sell gold at a future date. More complex and riskier.

Several strategies were popular in 2020 for those looking to add gold to their investment portfolio. These varied based on risk tolerance and investment goals.

Gold ETFs offer a simple and accessible way to diversify a portfolio. They track the price of gold and are traded on stock exchanges.

Fact: Gold ETFs often have low expense ratios, making them a cost-effective way to gain exposure to gold.

Gold mining stocks can provide leverage to the price of gold, but they also carry company-specific risks.

| Factor | Gold ETFs | Gold Mining Stocks |

|---|---|---|

| Price Correlation | High | Moderate |

| Risk | Lower | Higher |

| Expense Ratios/Operating Costs | Low | Company-Specific Factors |

Purchasing physical gold requires careful consideration of storage and security. Premiums over spot price also need to be factored in.

- Determine the amount of gold you want to purchase.

- Research reputable dealers and compare prices.

- Securely store your gold, either at home or in a vault.

Here are some frequently asked questions about investing in gold, especially relevant for 2020.

- Is gold a good investment during economic uncertainty? Gold is often seen as a safe haven asset, potentially holding its value or increasing during market downturns.

- What are the risks of investing in gold? Gold prices can be volatile, and physical gold requires secure storage. Gold mining stocks carry company-specific risks.

- How much of my portfolio should I allocate to gold? This depends on your risk tolerance and investment goals, but a common allocation is between 5% and 10%.

- Where can I buy gold? Gold can be purchased from reputable dealers, brokers, and online platforms.

But what if market conditions change unexpectedly? Shouldn’t you continually reassess your gold holdings in light of evolving economic indicators? And given the potential for geopolitical events to impact gold prices, are you actively monitoring world affairs? Perhaps you should consider the tax implications of owning gold, right? Have you consulted a tax professional to understand how gold investments might affect your overall tax liability? Wouldn’t it be wise to compare the performance of different gold ETFs before committing your capital? And shouldn’t you also explore alternative safe haven assets, such as government bonds, to ensure you’re making the most informed decision possible? Are you truly comfortable with the potential for gold prices to decline, even during times of economic turmoil? Finally, shouldn’t you establish a clear exit strategy for your gold investments, outlining when and why you might consider selling your holdings?

Investing in gold has long been considered a safe haven during times of economic uncertainty. In 2020, with global events creating market volatility, many investors looked to gold as a means of preserving capital and potentially growing their portfolios. Understanding the various methods of investing in gold, and their respective risks and rewards, is crucial for making informed decisions. This guide will explore the common strategies for investing in gold during 2020, and provide insights into navigating this precious metal market.

Understanding Gold Investment Options

Before diving in, it’s important to understand the different forms that gold investments can take. Each option has unique characteristics that may appeal to different investors.

- Physical Gold: Includes gold bars, coins, and jewelry. Requires secure storage.

- Gold ETFs (Exchange-Traded Funds): Track the price of gold, offering liquidity and ease of trading.

- Gold Mining Stocks: Investing in companies that mine gold. Performance is correlated, but not directly tied to gold prices.

- Gold Futures Contracts: Agreements to buy or sell gold at a future date. More complex and riskier.

Popular Gold Investment Strategies in 2020

Several strategies were popular in 2020 for those looking to add gold to their investment portfolio. These varied based on risk tolerance and investment goals.

Investing in Gold ETFs

Gold ETFs offer a simple and accessible way to diversify a portfolio. They track the price of gold and are traded on stock exchanges.

Fact: Gold ETFs often have low expense ratios, making them a cost-effective way to gain exposure to gold.

Gold mining stocks can provide leverage to the price of gold, but they also carry company-specific risks.

| Factor | Gold ETFs | Gold Mining Stocks |

|---|---|---|

| Price Correlation | High | Moderate |

| Risk | Lower | Higher |

| Expense Ratios/Operating Costs | Low | Company-Specific Factors |

Purchasing physical gold requires careful consideration of storage and security. Premiums over spot price also need to be factored in.

- Determine the amount of gold you want to purchase.

- Research reputable dealers and compare prices.

- Securely store your gold, either at home or in a vault.

Here are some frequently asked questions about investing in gold, especially relevant for 2020.

- Is gold a good investment during economic uncertainty? Gold is often seen as a safe haven asset, potentially holding its value or increasing during market downturns.

- What are the risks of investing in gold? Gold prices can be volatile, and physical gold requires secure storage. Gold mining stocks carry company-specific risks.

- How much of my portfolio should I allocate to gold? This depends on your risk tolerance and investment goals, but a common allocation is between 5% and 10%.

- Where can I buy gold? Gold can be purchased from reputable dealers, brokers, and online platforms.

But what if market conditions change unexpectedly? Shouldn’t you continually reassess your gold holdings in light of evolving economic indicators? And given the potential for geopolitical events to impact gold prices, are you actively monitoring world affairs? Perhaps you should consider the tax implications of owning gold, right? Have you consulted a tax professional to understand how gold investments might affect your overall tax liability? Wouldn’t it be wise to compare the performance of different gold ETFs before committing your capital? And shouldn’t you also explore alternative safe haven assets, such as government bonds, to ensure you’re making the most informed decision possible? Are you truly comfortable with the potential for gold prices to decline, even during times of economic turmoil? Finally, shouldn’t you establish a clear exit strategy for your gold investments, outlining when and why you might consider selling your holdings?

But beyond these crucial considerations, have you truly explored all the nuances of gold investing? Shouldn’t you delve deeper into understanding the specific expense ratios of various gold ETFs, and how these fees can impact your long-term returns? Are you aware of the potential for counterparty risk when investing in gold futures contracts, and have you assessed your comfort level with this level of complexity? Shouldn’t you research the reputation and financial stability of the gold dealers you’re considering buying physical gold from, ensuring you’re not falling prey to scams or overpaying for your precious metal? And what about the environmental and social impact of gold mining – are you factoring these ethical considerations into your investment decisions? Shouldn’t you be aware of the potential for currency fluctuations to affect the value of your gold investments, particularly if you’re investing in foreign-denominated gold assets? Have you explored the possibility of using a self-directed IRA to hold your gold investments, potentially gaining tax advantages? Shouldn’t you diversify your gold investments across different types of gold assets, rather than putting all your eggs in one basket? And finally, shouldn’t you stay informed about the latest developments in the gold market, attending industry conferences and subscribing to reputable financial publications to keep your knowledge up-to-date?