Navigating the world of investing can feel like traversing a complex maze, especially when considering less commonly known stocks like those classified under the Eeenf designation․ Understanding the nuances of the market, performing thorough due diligence, and having a clear investment strategy are crucial steps before diving into any investment, including Eeenf stocks․ The world of penny stocks and over-the-counter (OTC) markets where Eeenf stocks often reside, demands a keen awareness of the associated risks and potential rewards․ This guide aims to provide a foundational understanding of how to approach investing in these types of stocks, emphasizing the importance of informed decision-making․

Understanding Eeenf Stocks and OTC Markets

Eeenf stocks typically refer to stocks traded on the over-the-counter (OTC) markets․ These markets are less regulated than major exchanges like the New York Stock Exchange (NYSE) or Nasdaq․ Companies listed on OTC markets often have lower financial reporting requirements, which can lead to increased volatility and risk․

Key Characteristics of OTC Markets:

- Lower Reporting Standards: Companies may not be required to adhere to the same strict reporting standards as those on major exchanges․

- Higher Volatility: Due to less liquidity and fewer regulations, price swings can be more dramatic․

- Limited Information: Reliable information about companies listed on OTC markets can be scarce․

Steps to Take Before Investing

Before investing in any stock, especially Eeenf stocks, it’s critical to conduct thorough research and assessment․

- Research the Company: Dig deep into the company’s financials, business model, and management team․ Look for independent sources of information․

- Assess Your Risk Tolerance: OTC stocks are inherently riskier than those on major exchanges․ Ensure you are comfortable with the potential for significant losses․

- Diversify Your Portfolio: Never put all your eggs in one basket․ Diversification is key to mitigating risk․

- Understand the Market: Learn about the specific OTC market where the stock is traded (e․g․, OTCQB, OTCQX, Pink)․

- Set Realistic Expectations: Be wary of promises of quick riches․ Investing is a long-term game․

Finding and Evaluating Eeenf Stock Information

Accessing reliable information on companies trading on OTC markets can be challenging․ However, there are several resources you can utilize:

- Company Filings: Check the company’s website and any available filings with regulatory bodies․

- OTC Markets Group Website: This website provides information and data on OTC-listed companies․

- Financial News Websites: Look for news articles and analysis from reputable financial news sources․

Remember to critically evaluate all information and be skeptical of overly optimistic or promotional material․

Trading Eeenf Stocks

Trading Eeenf stocks generally involves opening an account with a brokerage that allows access to OTC markets․ Many major brokerages offer this access, but it’s important to confirm their specific policies and fees․ Be aware of potential order execution issues due to lower trading volumes․

FAQ About Investing in Eeenf Stocks

What are the main risks associated with Eeenf stocks?

The main risks include higher volatility, limited information, and potential for fraud․

How much should I invest in Eeenf stocks?

Only invest an amount you are comfortable losing, as these investments carry significant risk․

Where can I find information about Eeenf stocks?

Check company filings, the OTC Markets Group website, and reputable financial news sources․

Are Eeenf stocks a good investment for beginners?

Eeenf stocks are generally not recommended for beginners due to their high risk and complexity․

The journey of investing in Eeenf stocks requires careful consideration and a deep understanding of the associated risks․ The decision to invest in these types of securities should be carefully weighed against your own risk tolerance and financial goals․

Navigating the world of investing can feel like traversing a complex maze, especially when considering less commonly known stocks like those classified under the Eeenf designation․ Understanding the nuances of the market, performing thorough due diligence, and having a clear investment strategy are crucial steps before diving into any investment, including Eeenf stocks․ The world of penny stocks and over-the-counter (OTC) markets where Eeenf stocks often reside, demands a keen awareness of the associated risks and potential rewards․ This guide aims to provide a foundational understanding of how to approach investing in these types of stocks, emphasizing the importance of informed decision-making․

Eeenf stocks typically refer to stocks traded on the over-the-counter (OTC) markets․ These markets are less regulated than major exchanges like the New York Stock Exchange (NYSE) or Nasdaq․ Companies listed on OTC markets often have lower financial reporting requirements, which can lead to increased volatility and risk․

- Lower Reporting Standards: Companies may not be required to adhere to the same strict reporting standards as those on major exchanges․

- Higher Volatility: Due to less liquidity and fewer regulations, price swings can be more dramatic․

- Limited Information: Reliable information about companies listed on OTC markets can be scarce․

Before investing in any stock, especially Eeenf stocks, it’s critical to conduct thorough research and assessment․

- Research the Company: Dig deep into the company’s financials, business model, and management team․ Look for independent sources of information․

- Assess Your Risk Tolerance: OTC stocks are inherently riskier than those on major exchanges; Ensure you are comfortable with the potential for significant losses․

- Diversify Your Portfolio: Never put all your eggs in one basket; Diversification is key to mitigating risk․

- Understand the Market: Learn about the specific OTC market where the stock is traded (e․g․, OTCQB, OTCQX, Pink)․

- Set Realistic Expectations: Be wary of promises of quick riches․ Investing is a long-term game․

Accessing reliable information on companies trading on OTC markets can be challenging; However, there are several resources you can utilize:

- Company Filings: Check the company’s website and any available filings with regulatory bodies․

- OTC Markets Group Website: This website provides information and data on OTC-listed companies․

- Financial News Websites: Look for news articles and analysis from reputable financial news sources․

Remember to critically evaluate all information and be skeptical of overly optimistic or promotional material․

Trading Eeenf stocks generally involves opening an account with a brokerage that allows access to OTC markets․ Many major brokerages offer this access, but it’s important to confirm their specific policies and fees․ Be aware of potential order execution issues due to lower trading volumes․

The main risks include higher volatility, limited information, and potential for fraud․

Only invest an amount you are comfortable losing, as these investments carry significant risk․

Check company filings, the OTC Markets Group website, and reputable financial news sources․

Eeenf stocks are generally not recommended for beginners due to their high risk and complexity․

The journey of investing in Eeenf stocks requires careful consideration and a deep understanding of the associated risks․ The decision to invest in these types of securities should be carefully weighed against your own risk tolerance and financial goals․

Beyond the Basics: Advanced Considerations

Now that you have a foundational understanding, let’s delve into some more advanced aspects of navigating the Eeenf stock landscape․ Consider these points as you refine your investment strategy․ Remember, investing is a continuous learning process․

Understanding Market Makers

OTC markets rely heavily on market makers․ These firms are responsible for providing liquidity by quoting bid and ask prices for specific stocks․ It’s crucial to understand how market makers operate, as their actions can significantly influence price movements․ Be wary of situations where a single market maker dominates trading volume, as this could indicate potential manipulation․

The Importance of Due Diligence ― Red Flags to Watch For

Due diligence isn’t just reading a company’s press releases․ It’s about proactively seeking out potential problems․ Here are some red flags that should raise serious concerns:

- Frequent Stock Splits or Reverse Splits: These can be signs of a struggling company trying to manipulate its share price․

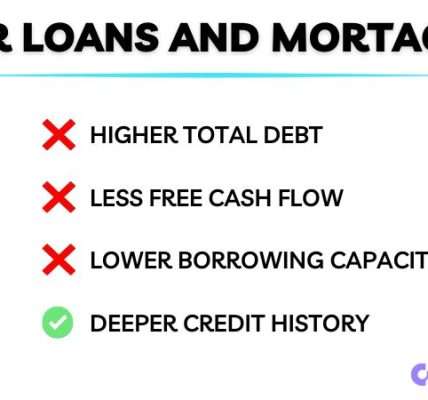

- Significant Debt Levels: High debt can cripple a company’s ability to grow and innovate․

- Lack of Transparency: If a company is unwilling to provide clear and comprehensive information, it’s a major warning sign․

- Overly Promotional Language: Be skeptical of companies that use overly hyped or exaggerated claims about their prospects․

- Unexplained Spikes in Trading Volume: Sudden and dramatic increases in trading volume without any apparent news or catalyst can indicate insider trading or manipulation․

Technical Analysis and Charting

While fundamental analysis is crucial, technical analysis can also provide valuable insights into potential entry and exit points․ Learning to read charts, identify trends, and use technical indicators can help you make more informed trading decisions․ However, remember that technical analysis is not foolproof, especially in the volatile world of OTC stocks․ Consider using these tools in conjunction with fundamental research․

Thinking Long-Term (If Appropriate)

While many Eeenf stocks are speculative plays, it’s possible to find companies with genuine long-term potential․ If you believe in the company’s business model and management team, consider holding the stock for the long haul․ However, be prepared to weather significant volatility and be prepared to re-evaluate your investment thesis as the company evolves․

Final Thoughts and a Word of Caution

Investing in Eeenf stocks is not for the faint of heart․ It requires a significant amount of research, discipline, and a high tolerance for risk․ Never invest more than you can afford to lose, and always remember to diversify your portfolio․ While the potential for high returns exists, the risk of substantial losses is equally real․ Before you dive into the world of Eeenf stocks, take the time to educate yourself, develop a sound investment strategy, and seek advice from a qualified financial advisor․ Remember to always remain vigilant, and be prepared to adapt your strategy as market conditions change․ Approach investing in Eeenf stocks with caution, and prioritize protecting your capital above all else․