Buying a home and a car are two of the biggest financial decisions most people make. While both are significant purchases‚ having an existing car loan can substantially impact your ability to qualify for a mortgage. Understanding how these debts interact is crucial for effective financial planning and achieving your homeownership goals. This article will explore the ways a car loan can affect your mortgage application‚ offering insights into managing your debt and maximizing your chances of approval.

Understanding Debt-to-Income Ratio (DTI)

One of the most critical factors lenders consider when evaluating mortgage applications is your Debt-to-Income Ratio (DTI). This ratio compares your monthly debt payments to your gross monthly income. A high DTI can signal to lenders that you might be overextended financially‚ making it harder to manage additional debt like a mortgage.

How Car Loans Impact DTI

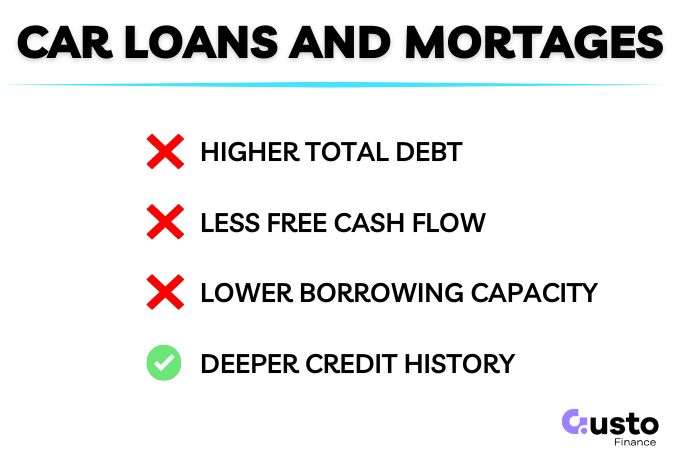

Your car loan payment directly contributes to your total monthly debt. Here’s how it affects your DTI calculation:

- Increased Monthly Debt: Adding a car payment increases your overall monthly debt burden.

- Higher DTI: A higher debt burden translates to a higher DTI ratio.

- Reduced Borrowing Power: Lenders often have maximum DTI thresholds; exceeding these limits can disqualify you from receiving a mortgage or reduce the amount you can borrow.

Credit Score Considerations

Your credit score is another vital component of your mortgage application. A good credit score indicates responsible financial behavior and reduces the lender’s risk. Car loans can affect your credit score in several ways.

Fact: Making timely payments on your car loan helps build a positive credit history‚ but missed or late payments can significantly damage your credit score.

Payment History

Payment history is the most influential factor in determining your credit score. Consistent‚ on-time payments on your car loan demonstrate responsible credit management.

Conversely‚ even a single missed car payment can negatively impact your credit score‚ potentially affecting your mortgage interest rate or even your approval chances.

Credit Utilization

While car loans don’t directly impact credit utilization (which is more relevant for credit cards)‚ having a car loan can indirectly affect it. For example‚ if you have multiple debts‚ including a car loan‚ it can make it harder to manage your overall credit effectively‚ potentially leading to missed payments or overspending on credit cards.

Strategies for Minimizing the Impact

Fortunately‚ there are steps you can take to mitigate the negative impact of a car loan on your mortgage application.

| Strategy | Description |

|---|---|

| Pay Down Debt | Prioritize paying down your car loan balance to reduce your monthly payment and lower your DTI. |

| Increase Income | Explore opportunities to increase your income‚ such as a side hustle or seeking a promotion at work. A higher income will lower your DTI. |

| Shop Around for Mortgage Rates | Different lenders have varying DTI requirements. Shop around and compare mortgage rates and eligibility criteria from multiple lenders. |

| Delay Purchasing a Home | Consider delaying your home purchase until you have paid off a significant portion of your car loan. |

FAQ: Car Loans and Mortgages

Here are some frequently asked questions about how car loans affect mortgage applications.

Will a car loan automatically disqualify me from getting a mortgage?

No‚ a car loan will not automatically disqualify you. However‚ it will impact your DTI and credit score‚ which are important factors in mortgage approval.

How much of a car loan is too much when applying for a mortgage?

There’s no one-size-fits-all answer. It depends on your income‚ other debts‚ and the lender’s DTI requirements. Aim for a DTI below 43% for a better chance of approval.

Can I refinance my car loan to improve my mortgage application?

Yes‚ refinancing your car loan to a lower interest rate or longer term can reduce your monthly payment and improve your DTI. However‚ a longer loan term means paying more interest overall.

Navigating the complexities of managing a car loan while pursuing a mortgage requires careful planning and financial discipline. The impact of a car loan on your mortgage application hinges primarily on your DTI and credit score‚ both of which are key indicators of your financial stability. By proactively addressing your debt‚ exploring options to increase your income‚ and understanding lender requirements‚ you can significantly improve your chances of securing a mortgage and realizing your dream of homeownership. Remember‚ a balanced financial approach is crucial for achieving both your transportation and housing goals. Consulting with a financial advisor or mortgage professional can provide personalized guidance tailored to your specific circumstances. Making informed decisions now will pave the way for a smoother and more successful home-buying journey.