Forex trading can seem daunting, especially for newcomers. The complexities of currency pairs, technical analysis, and risk management often create a steep learning curve. Copy trading offers a potentially simpler entry point, allowing individuals to leverage the expertise of seasoned traders. This guide will delve into the mechanics of copy trading in forex, exploring its benefits, risks, and practical implementation.

Understanding the Basics of Forex Copy Trading

Copy trading, at its core, involves automatically replicating the trades of another trader. You essentially link your trading account to theirs, and every time they execute a trade, the same trade is mirrored in your account, proportionally to your investment.

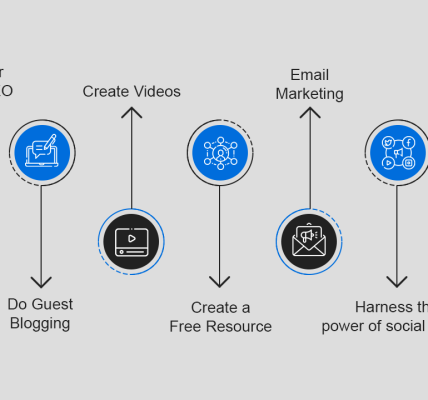

How the Process Works: A Step-by-Step Breakdown

The following outlines the general process of engaging in copy trading:

- Choose a Platform: Select a reputable copy trading platform that offers access to a variety of traders.

- Evaluate Traders: Analyze the performance metrics of potential traders to copy (profitability, risk score, trading style, etc.).

- Allocate Funds: Determine the amount of capital you want to allocate to copying a specific trader.

- Configure Settings: Set parameters such as stop-loss orders and maximum investment per trade to manage risk.

- Monitor Performance: Regularly review the performance of the copied trader and adjust your settings as needed.

Advantages and Disadvantages of Copy Trading

Like any investment strategy, copy trading presents both potential benefits and inherent risks. It’s crucial to weigh these factors carefully before committing capital.

Pros and Cons at a Glance

| Advantages | Disadvantages |

|---|---|

| Potential to learn from experienced traders. | Past performance is not indicative of future results. |

| Diversification of trading strategies. | Risk of losses if the copied trader makes poor decisions. |

| Reduced time commitment compared to independent trading. | Platform fees and commissions can reduce profits. |

| Opportunity to generate passive income. | Lack of control over individual trades. |

Key Considerations When Selecting a Trader to Copy

Choosing the right trader to copy is paramount to the success of your copy trading venture. Focus on consistency and transparency.

Evaluating Trader Performance

Here are some essential factors to consider:

- Profitability: Review the trader’s historical profit margins and win rate.

- Risk Score: Assess the trader’s risk tolerance and drawdown levels.

- Trading Style: Understand the trader’s preferred currency pairs, trading frequency, and risk management techniques.

- Trading History: Look for a consistent trading history with stable results over a long period. Avoid those with high volatility.

FAQ: Frequently Asked Questions About Copy Trading

This section addresses some common questions regarding copy trading in forex.

What are the risks associated with copy trading?

Copy trading carries the risk of financial loss if the copied trader makes unsuccessful trades. Market volatility, unexpected economic events, and the trader’s individual risk tolerance can all contribute to losses.

How much capital do I need to start copy trading?

The minimum capital requirement varies depending on the platform. Some platforms allow you to start with as little as $100, while others may require a larger initial investment.

Can I stop copying a trader at any time?

Yes, you typically have the flexibility to stop copying a trader at any time. Your open positions will be closed, and your funds will be returned to your account, subject to any platform fees or regulations.

What fees are involved in copy trading?

Copy trading platforms often charge fees, which can include commissions on successful trades, spread markups, and subscription fees. Be sure to thoroughly review the fee structure before committing to a platform.

Forex trading can seem daunting, especially for newcomers. The complexities of currency pairs, technical analysis, and risk management often create a steep learning curve. Copy trading offers a potentially simpler entry point, allowing individuals to leverage the expertise of seasoned traders. This guide will delve into the mechanics of copy trading in forex, exploring its benefits, risks, and practical implementation.

Copy trading, at its core, involves automatically replicating the trades of another trader. You essentially link your trading account to theirs, and every time they execute a trade, the same trade is mirrored in your account, proportionally to your investment.

The following outlines the general process of engaging in copy trading:

- Choose a Platform: Select a reputable copy trading platform that offers access to a variety of traders.

- Evaluate Traders: Analyze the performance metrics of potential traders to copy (profitability, risk score, trading style, etc.).

- Allocate Funds: Determine the amount of capital you want to allocate to copying a specific trader.

- Configure Settings: Set parameters such as stop-loss orders and maximum investment per trade to manage risk.

- Monitor Performance: Regularly review the performance of the copied trader and adjust your settings as needed.

Like any investment strategy, copy trading presents both potential benefits and inherent risks. It’s crucial to weigh these factors carefully before committing capital.

| Advantages | Disadvantages |

|---|---|

| Potential to learn from experienced traders. | Past performance is not indicative of future results. |

| Diversification of trading strategies. | Risk of losses if the copied trader makes poor decisions. |

| Reduced time commitment compared to independent trading. | Platform fees and commissions can reduce profits. |

| Opportunity to generate passive income; | Lack of control over individual trades. |

Choosing the right trader to copy is paramount to the success of your copy trading venture. Focus on consistency and transparency.

Here are some essential factors to consider:

- Profitability: Review the trader’s historical profit margins and win rate.

- Risk Score: Assess the trader’s risk tolerance and drawdown levels.

- Trading Style: Understand the trader’s preferred currency pairs, trading frequency, and risk management techniques.

- Trading History: Look for a consistent trading history with stable results over a long period. Avoid those with high volatility.

This section addresses some common questions regarding copy trading in forex.

Copy trading carries the risk of financial loss if the copied trader makes unsuccessful trades. Market volatility, unexpected economic events, and the trader’s individual risk tolerance can all contribute to losses.

The minimum capital requirement varies depending on the platform. Some platforms allow you to start with as little as $100, while others may require a larger initial investment.

Yes, you typically have the flexibility to stop copying a trader at any time. Your open positions will be closed, and your funds will be returned to your account, subject to any platform fees or regulations.

Copy trading platforms often charge fees, which can include commissions on successful trades, spread markups, and subscription fees. Be sure to thoroughly review the fee structure before committing to a platform.

Advanced Copy Trading Strategies

Once you grasp the fundamentals, are there ways to refine your copy trading approach? Are there specific strategies successful copy traders employ to maximize returns and minimize risk?

Diversification: The Key to Risk Mitigation?

Is putting all your eggs in one basket ever a good idea, even when copying a seemingly successful trader? Wouldn’t diversifying by copying multiple traders with different styles potentially smooth out your returns?

- Should you allocate smaller portions of your capital to several traders instead of a large chunk to just one?

- Does this approach require more active monitoring and adjustments, or is it a set-and-forget strategy?

- What are the potential downsides of diversifying too much – might it dilute your profits or make it harder to track performance?

The Psychology of Copy Trading

Beyond the technical aspects, does the emotional side of investing still play a role in copy trading? How do you handle the inevitable losing streaks of the traders you’re copying?

Staying Calm in the Face of Drawdown

When a copied trader experiences a drawdown, does panic selling ever make sense? Or is it crucial to stick to your initial plan and trust their long-term strategy?

Consider this table:

| Scenario | Potential Emotional Response | More Rational Response |

|---|---|---|

| Trader experiences a 10% drawdown. | Panic, fear of further losses, urge to stop copying. | Review their overall strategy, assess if anything has fundamentally changed, consider adjusting stop-loss. |

| Trader has a string of winning trades. | Overconfidence, temptation to increase investment. | Maintain consistent risk management, avoid chasing profits. |

Is it truly passive?

Can you consider copy trading a truly hands-off investment? Do you need to constantly monitor the trader’s performance, and adjust settings?

- What kind of time commitment is required to effectively manage a copy trading portfolio?

- Can you truly “set it and forget it,” or is regular monitoring essential to success?

Ultimately, are you comfortable entrusting your capital to someone else’s decisions? How much due diligence is enough to ensure you’re making the right choices? And, what are the tax implications of copy trading, and how can you best prepare for them?