Securing a car loan is a significant financial step for many. Understanding the requirements involved is crucial to ensure a smooth and successful application process. A common question among prospective car buyers is whether proof of income is necessary. The answer‚ generally‚ is yes‚ and this article will explore why lenders require it and what forms of income verification are typically accepted. We’ll also delve into alternative scenarios for those with non-traditional income streams or limited income history;

Why Lenders Need Proof of Income

Lenders require proof of income to assess your ability to repay the loan. This helps them mitigate the risk of default and ensures responsible lending practices.

Assessing Repayment Ability

Proof of income allows lenders to accurately calculate your debt-to-income ratio (DTI). This ratio compares your monthly debt payments to your gross monthly income.

- Lower DTI: Indicates a higher capacity to manage debt and increases your chances of loan approval.

- Higher DTI: Suggests a greater risk of default‚ potentially leading to loan denial or higher interest rates.

Minimizing Risk for Lenders

Lenders need assurance that borrowers can consistently make payments. Verified income helps them make informed lending decisions.

Acceptable Forms of Income Verification

Different lenders accept various forms of income verification. Here are some of the most common:

| Document Type | Description |

|---|---|

| Pay Stubs | Recent pay stubs (typically covering the last 30 days) showing your gross income. |

| W-2 Forms | Annual wage and tax statements from your employer‚ detailing your earnings for the previous year. |

| Tax Returns | Copies of your federal income tax returns‚ particularly if you are self-employed or have multiple income sources. |

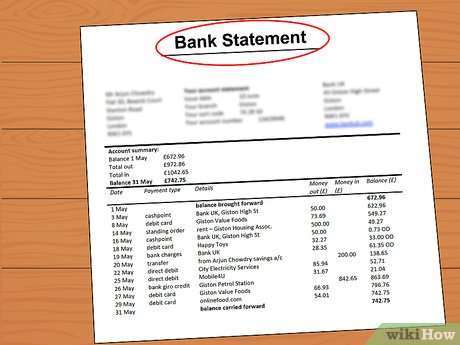

| Bank Statements | Statements showing consistent deposits‚ which can be used to verify income for freelancers or those with irregular pay schedules. |

| Social Security Award Letter | Proof of Social Security benefits‚ which can be used to supplement other income sources. |

Alternative Scenarios and Solutions

What happens if you don’t have traditional income or a consistent employment history? There are still options available‚ though they may require some extra effort.

Co-signers and Guarantors

A co-signer with a stable income and good credit can help secure a loan. They essentially vouch for your ability to repay.

Secured Loans

Consider a secured loan‚ where you offer collateral (like savings accounts or other assets) to offset the lender’s risk.

Larger Down Payment

Increasing the down payment can reduce the loan amount and lower the lender’s risk‚ potentially making it easier to get approved even with limited income verification.

Fact: A larger down payment can also lower your monthly payments.

FAQ Section

Here are some frequently asked questions related to car loan income requirements:

Q: Can I get a car loan with no proof of income?

A: It’s very difficult‚ but not impossible. Some dealerships might offer “no income verification” loans‚ but these often come with very high interest rates and less favorable terms.

Q: What if I am self-employed?

A: Lenders will typically request tax returns from the past two years to verify your income. They may also ask for bank statements to confirm consistent deposits.

Q: Will a low credit score affect my chances of getting approved‚ even with proof of income?

A: Yes‚ your credit score is a significant factor. A lower credit score may result in higher interest rates or loan denial‚ even if you can provide proof of income.

Q: What if I am unemployed but have substantial savings?

A: Some lenders may consider your savings as a compensating factor‚ but it’s not a guarantee. They will likely want to see how you plan to repay the loan without a regular income.