Navigating the world of business finances can often feel like traversing a complex maze‚ especially when dealing with refunds and adjustments. Understanding the nuances of financial documents is crucial for maintaining accurate records and ensuring smooth transactions. One such document‚ the credit note against invoice refund‚ plays a significant role in correcting errors and processing reimbursements. This article delves into the intricacies of this financial tool‚ offering a comprehensive guide to its purpose‚ usage‚ and benefits. It’s designed to demystify the process and provide you with the knowledge needed to confidently handle credit note against invoice refund scenarios.

What is a Credit Note Against Invoice Refund?

A credit note‚ sometimes referred to as a credit memo‚ is a document issued by a seller to a buyer‚ reducing the amount the buyer owes on an invoice. It’s essentially a negative invoice‚ indicating a reduction in the original amount charged. The “against invoice refund” portion specifies that the credit is being issued to offset a previously issued invoice‚ often due to reasons like:

- Returned goods

- Pricing errors

- Damaged goods

- Overpayments

- Discounts or rebates not initially applied

Why Use a Credit Note Instead of a Straight Refund?

While a direct refund might seem like the most straightforward solution‚ credit notes offer several advantages‚ especially for businesses dealing with ongoing transactions:

- Simplified Accounting: Credit notes provide a clear audit trail‚ linking the credit directly to the original invoice. This makes reconciliation easier and reduces the risk of errors.

- Future Purchases: The credit can be used towards future purchases‚ fostering continued business relationships.

- Correcting Invoices: Credit notes are ideal for correcting minor invoice discrepancies without the need to completely void and reissue the original invoice.

How Does a Credit Note Against Invoice Refund Work?

The process typically involves the following steps:

- Issue Identification: The buyer identifies an issue with the invoice (e.g.‚ incorrect price‚ damaged goods).

- Seller Verification: The seller verifies the issue and agrees to issue a credit.

- Credit Note Creation: The seller creates a credit note referencing the original invoice number‚ the reason for the credit‚ and the amount to be credited.

- Credit Note Delivery: The credit note is sent to the buyer.

- Application of Credit: The buyer applies the credit to the outstanding invoice balance or uses it towards a future purchase;

Imagine a scenario where a company‚ “Tech Solutions‚” sends an invoice for $1000 worth of computer equipment to “Office Supplies Inc.” However‚ upon delivery‚ Office Supplies Inc. discovers that one of the monitors is damaged. Tech Solutions issues a credit note against invoice refund for $200 to compensate for the damaged monitor. Office Supplies Inc. can then either deduct $200 from the original invoice amount or apply the $200 credit towards a future purchase from Tech Solutions.

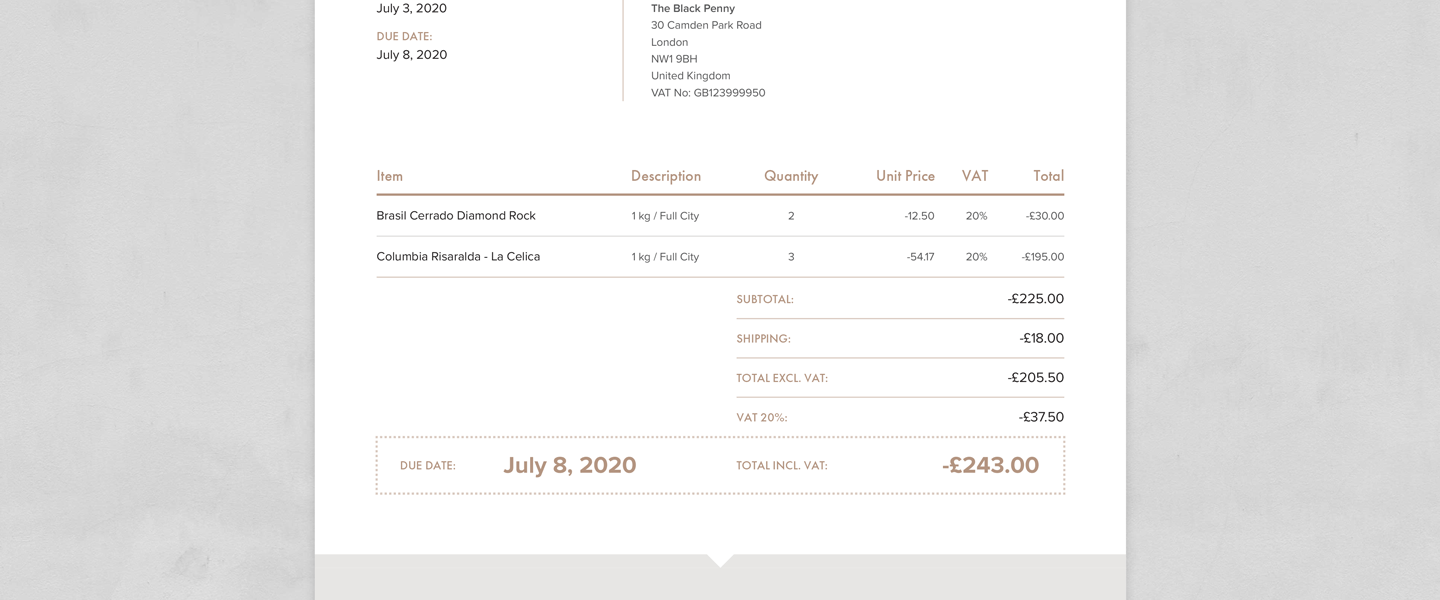

Key Information on a Credit Note

A credit note should include the following information:

- Seller’s name and address

- Buyer’s name and address

- Credit note number

- Date of issue

- Original invoice number

- Description of goods or services

- Reason for the credit

- Amount of the credit (both before and after any applicable taxes)

Understanding the intricacies of financial documents like the credit note against invoice refund is essential for maintaining accurate accounting practices and fostering positive relationships with your business partners.

.

Best Practices for Handling Credit Notes

To ensure smooth and efficient handling of credit notes‚ consider implementing these best practices within your organization:

- Establish a Clear Policy: Define a clear policy outlining the circumstances under which credit notes will be issued‚ the approval process‚ and the documentation required. This will help standardize the process and prevent inconsistencies.

- Implement a Tracking System: Use accounting software or a dedicated system to track all credit notes issued and received; This will provide a comprehensive overview of outstanding credits and ensure that they are properly applied.

- Train Your Staff: Train your staff on the proper procedures for issuing and processing credit notes. This includes understanding the different reasons for issuing a credit‚ the information that needs to be included on the credit note‚ and how to apply the credit to an invoice.

- Regularly Reconcile Accounts: Regularly reconcile your accounts receivable and accounts payable to ensure that all credit notes have been properly applied. This will help identify any discrepancies and prevent errors from accumulating.

- Maintain Accurate Records: Keep accurate records of all credit notes issued and received‚ including copies of the original invoices‚ the credit notes themselves‚ and any supporting documentation. This will provide a clear audit trail and facilitate dispute resolution.

Common Mistakes to Avoid

While credit notes can be a valuable tool‚ it’s important to avoid these common mistakes:

- Issuing Credit Notes Without Proper Authorization: Ensure that all credit notes are properly authorized by a designated individual or department. This will prevent unauthorized credits from being issued and protect your company from financial losses.

- Failing to Link Credit Notes to Original Invoices: Always link credit notes to the original invoices. This is crucial for maintaining a clear audit trail and ensuring that the credit is applied to the correct account.

- Using Credit Notes as a Substitute for Refunds: While credit notes can be used to offset future purchases‚ they should not be used as a substitute for refunds when a customer specifically requests a refund. Respect the customer’s preference and process the refund accordingly.

- Ignoring Tax Implications: Be aware of the tax implications of issuing credit notes. Consult with a tax professional to ensure that you are complying with all applicable tax laws and regulations.

The Future of Credit Notes: Digitalization and Automation

The future of credit notes is likely to be shaped by digitalization and automation. Electronic invoicing and accounting software are making it easier than ever to create‚ send‚ and track credit notes. Automation can streamline the entire process‚ reducing manual effort and minimizing the risk of errors. This includes automatically generating credit notes based on pre-defined criteria‚ automatically applying credits to invoices‚ and automatically reconciling accounts. As technology continues to advance‚ credit notes are likely to become even more efficient and integrated into the overall financial management process.