Capital investment is a crucial aspect of financial planning for businesses of all sizes. Understanding how to accurately calculate it allows companies to make informed decisions about resource allocation, project feasibility, and overall growth strategy. This process involves analyzing various factors to determine the initial cost of an investment and its potential return. By mastering these calculations, businesses can ensure they are making sound financial choices that contribute to their long-term success.

Understanding the Basics of Capital Investment

Capital investments are funds used by a company to acquire or upgrade physical assets such as property, equipment, or buildings. These investments are typically long-term and are expected to generate revenue or cost savings over several years.

Common Types of Capital Investments

Capital investments can take many forms. Here are some frequent examples:

- Property, Plant, and Equipment (PP&E): Purchasing land, buildings, machinery, or vehicles.

- Research and Development (R&D): Investing in new technologies or product development.

- Acquisitions: Buying another company or its assets.

- Software and Technology: Implementing new software systems or upgrading existing IT infrastructure.

Methods for Calculating Capital Investment

Several methods can be used to calculate capital investment. Each has its own advantages and disadvantages, depending on the specific project and available data.

Initial Investment Calculation

Determining the initial investment is the first step. This includes not only the purchase price but also any associated costs.

The initial investment calculation typically includes the following components:

| Component | Description |

|---|---|

| Purchase Price | The cost of the asset being acquired. |

| Installation Costs | Expenses related to setting up the asset for use. |

| Shipping and Handling | Costs associated with transporting the asset. |

| Training Costs | Expenses for training employees to use the new asset. |

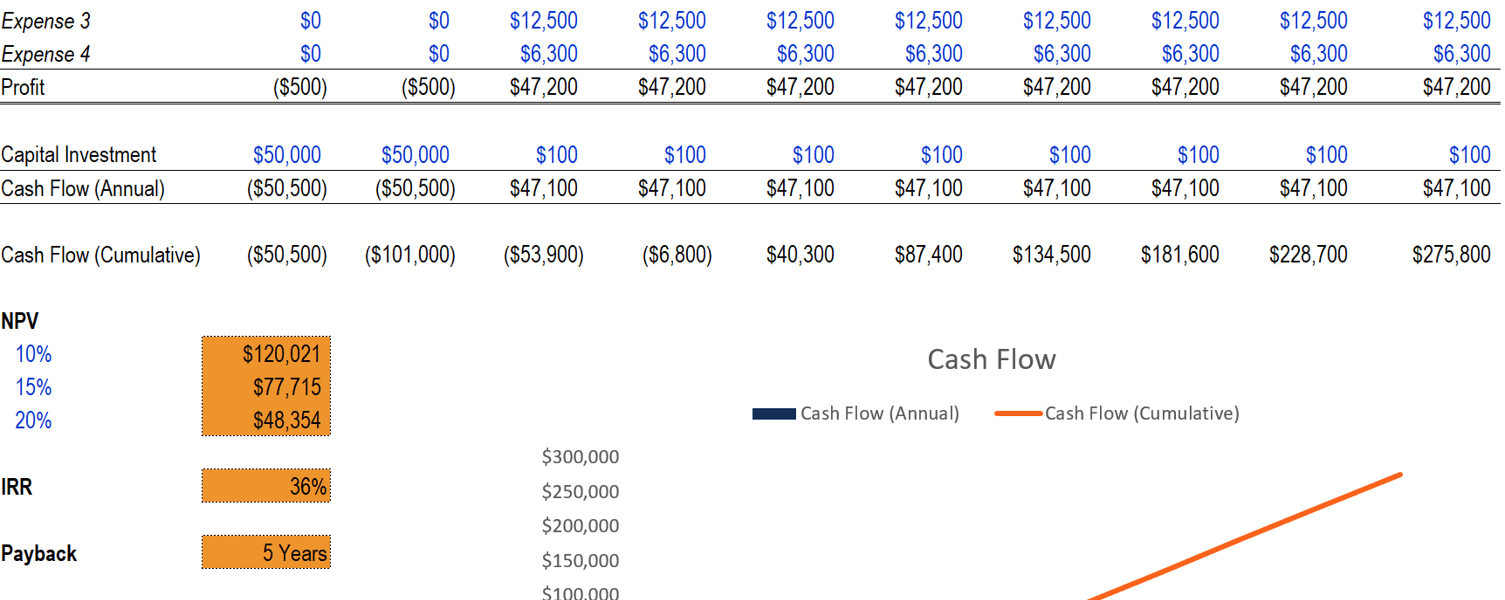

Net Present Value (NPV)

NPV is a common method for evaluating the profitability of a capital investment by comparing the present value of future cash inflows to the initial investment.

Formula: NPV = Σ (Cash Flow / (1 + Discount Rate)^Year) ― Initial Investment

Internal Rate of Return (IRR)

The IRR is the discount rate that makes the NPV of all cash flows from a particular project equal to zero.

Fact: A higher IRR generally indicates a more desirable investment.

FAQ: Calculating Capital Investment

Here are some frequently asked questions about calculating capital investment:

- What is a discount rate? The discount rate is the rate used to discount future cash flows back to their present value. It represents the opportunity cost of capital.

- Why is it important to consider all costs associated with a capital investment? Failure to include all costs can lead to an underestimation of the total investment and potentially inaccurate financial projections.

- How often should capital investment calculations be reviewed? Calculations should be reviewed regularly, especially when market conditions or project parameters change.

Capital investment decisions are vital for the success of any business. By understanding the different methods and factors involved, companies can make informed choices that align with their strategic goals and financial objectives. Accurate calculations are essential for assessing the potential return on investment and mitigating risks. Thorough analysis will help to allocate resources effectively and ensure sustainable growth. Neglecting this crucial aspect of financial planning can lead to missed opportunities and potential financial instability. Therefore, a solid understanding of capital investment calculation is essential for all financial professionals and business owners alike.

Beyond the Numbers: The Art of Capital Alchemy

While formulas and spreadsheets provide the framework, true mastery of capital investment transcends mere calculation. It’s about understanding the nuances, the whispers of the market, and the intangible potential hidden within each project. It’s about transforming seemingly disparate assets into something truly valuable.

The Oracle of Opportunity Cost

Opportunity cost isn’t just a dry term in an economics textbook; it’s a living, breathing entity that demands respect. It’s the ghost of the project not chosen, the road not taken. Every investment decision is a delicate dance with this unseen force.

Consider this:

| Investment | Projected ROI | Opportunity Cost | The Real Question |

|---|---|---|---|

| AI-Powered Customer Service | 20% | Delayed expansion into new markets | Is a 20% return worth sacrificing a potential foothold in a burgeoning market? |

| New Manufacturing Equipment | 15% | Employee retraining and potential resistance to change | Can we manage the human element and ensure a smooth transition, or will the equipment become a costly paperweight? |

The Zen of Discount Rates: A Journey Inward

Forget the risk-free rate plus a premium; the discount rate is a deeply personal reflection of your company’s appetite for adventure. It’s a gut feeling translated into a percentage, a whispered prayer against uncertainty.

Imagine: You’re standing at the edge of a financial cliff, gazing into the foggy abyss of future cash flows. The discount rate is the rope you use to rappel down, its strength dictated by your belief in the project’s underlying stability.

Deconstructing the Crystal Ball: Scenario Planning

No one possesses a perfect crystal ball, but scenario planning offers the next best thing. It’s about embracing uncertainty, acknowledging the myriad paths the future might take, and preparing accordingly.

The Scenario Matrix:

- Best-Case Scenario: Demand skyrockets, costs plummet, and the competition mysteriously vanishes. (Think unicorn sightings and pots of gold.)

- Worst-Case Scenario: A global recession hits, supply chains collapse, and a swarm of locusts devours your profits. (Bring your apocalypse survival kit.)

- Most Likely Scenario: A realistic assessment of market conditions, considering potential challenges and opportunities. (Where the real work happens.)

The Capital Alchemist’s Touch: Beyond the Spreadsheet

Capital investment isn’t just about numbers; it’s about vision, courage, and a healthy dose of intuition. It’s about seeing the potential where others see only risk, and transforming ideas into tangible assets that drive lasting value. It requires more than just financial acumen; it requires the touch of an alchemist, turning base metals into gold. Understanding the art of capital investment is not just a skill, it is a journey that requires careful consideration and constant refinement. The world of finance is not static. Stay informed, remain adaptable, and keep the alchemist’s fire burning brightly.