Business Development Companies (BDCs) are a unique type of investment vehicle, offering access to privately held and smaller public companies. Understanding their regulatory framework is crucial for investors considering adding them to their portfolios. BDCs operate under specific regulations designed to protect investors while allowing them to participate in the growth of developing businesses. This article will delve into whether BDCs are registered investment companies and explore the implications of their regulatory status.

What is a Business Development Company (BDC)?

Before exploring their registration status, it’s important to understand what BDCs are and what they do.

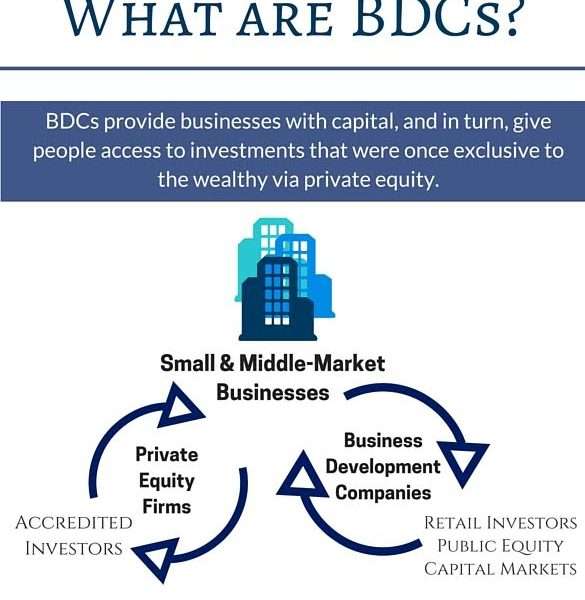

A Business Development Company (BDC) is a U.S. publicly traded company that invests in small and medium-sized businesses. They provide capital to these companies, often in the form of debt or equity, to facilitate growth, acquisitions, or recapitalizations.

Key Characteristics of BDCs:

- Investment Focus: Primarily target privately held companies or smaller public companies.

- Capital Provision: Offer debt or equity financing.

- Publicly Traded: Shares are traded on major stock exchanges, providing liquidity for investors.

- Regulatory Oversight: Subject to specific regulations to protect investors.

- Income Generation: Aim to generate current income for shareholders through dividends.

BDCs and the Investment Company Act of 1940

The Investment Company Act of 1940 plays a crucial role in regulating investment companies. Let’s examine how BDCs fit into this regulatory landscape.

Yes, Business Development Companies are indeed registered investment companies under the Investment Company Act of 1940. However, they operate under a specific exemption, allowing them to function with greater flexibility than traditional investment companies.

Key Differences Between BDCs and Traditional Investment Companies:

| Feature | BDC | Traditional Investment Company |

|---|---|---|

| Investment Focus | Primarily private companies | Publicly traded securities |

| Leverage | Higher leverage allowed | More restricted leverage |

| Management Fees | Performance-based fees allowed | More regulated fee structures |

Implications of BDC Registration

Being registered investment companies, even with an exemption, carries significant implications for BDCs.

Registration under the Investment Company Act of 1940 subjects BDCs to specific regulations regarding capital structure, asset coverage, and reporting requirements. This is designed to protect investors from excessive risk.

Benefits of Registration:

- Investor Protection: Regulations aim to prevent mismanagement and fraud.

- Transparency: Required reporting provides investors with detailed information about the BDC’s operations and financial performance.

- Governance: Rules governing board composition and related-party transactions promote good corporate governance.

FAQ Section

Here are some frequently asked questions about BDCs:

Q: What are the main risks associated with investing in BDCs?

A: Risks include credit risk (the risk that borrowers will default), interest rate risk, and market risk. BDCs often invest in higher-yield, higher-risk debt, which can lead to greater volatility.

Q: How do BDCs generate income for investors?

A: BDCs primarily generate income through interest payments on debt investments and dividends from equity investments. They are required to distribute a significant portion of their income to shareholders.

Q: Are BDCs suitable for all investors?

A: BDCs are generally considered suitable for investors with a higher risk tolerance and a longer investment horizon. Due to their complexity and potential volatility, they may not be appropriate for all investors.

Q: How can I research BDCs before investing?

A: Review the BDC’s SEC filings, including their annual reports (Form 10-K) and quarterly reports (Form 10-Q). Also, research industry analysts’ reports and consider consulting with a financial advisor.