Being a small business owner in Australia comes with a unique set of challenges, and tax time can often feel like the biggest hurdle. Successfully navigating the Australian tax system requires diligent record-keeping, a solid understanding of eligible deductions, and proactive planning throughout the year. Many small business owners find themselves scrambling at the last minute, leading to errors, missed opportunities, and unnecessary stress. Therefore, learning how to effectively prepare for tax time will not only save you time and money but also provide peace of mind, allowing you to focus on growing your business. Let’s delve into practical steps you can take to ace tax time.

Mastering Your Financial Records: The Foundation of Tax Success

Accurate and organized financial records are the cornerstone of a smooth tax process. Without them, you’re essentially flying blind, increasing the risk of errors and potentially missing out on valuable deductions. Here’s a breakdown of essential record-keeping practices:

- Maintain Separate Business and Personal Accounts: This is crucial for clarity and simplifies tracking business-related expenses.

- Track All Income and Expenses: Use accounting software, spreadsheets, or even a dedicated notebook to meticulously record every transaction. Consider cloud-based solutions for accessibility and backup.

- Keep Detailed Receipts: Develop a system for storing receipts, whether physical or digital. Apps that allow you to scan and categorize receipts can be a lifesaver.

- Reconcile Bank Statements Regularly: Ensure your bank statements match your recorded transactions. This helps identify errors and potential fraud.

Understanding Deductible Expenses: Maximizing Your Returns

One of the most significant ways to reduce your tax liability is by claiming all eligible deductions. The Australian Taxation Office (ATO) allows various deductions for small businesses. Here are some common categories:

- Operating Expenses: This includes costs such as rent, utilities, phone bills, internet access, and office supplies.

- Motor Vehicle Expenses: You can claim deductions for business-related car expenses, using either the logbook method or the cents-per-kilometre method. Keep accurate records of your mileage.

- Home Office Expenses: If you work from home, you may be able to deduct a portion of your home office expenses, such as electricity, heating, and internet.

- Depreciation: You can deduct the depreciation of business assets over their useful life.

- Superannuation Contributions: Contributions to your employees’ superannuation funds are generally deductible.

- Professional Development: Costs associated with training and development relevant to your business are often deductible.

Comparative Table: Logbook vs. Cents-per-Kilometre Method for Car Expenses

| Feature | Logbook Method | Cents-per-Kilometre Method |

|---|---|---|

| Record Keeping | Requires a detailed logbook tracking all business and personal trips for at least 12 continuous weeks. | Requires records of total kilometres travelled and kilometres travelled for business purposes. |

| Deduction Calculation | Deduction is based on the percentage of business use determined by the logbook. | Deduction is calculated by multiplying the business kilometres travelled by a set rate per kilometre (determined by the ATO). |

| Maximum Kilometres | No limit on the number of business kilometres you can claim. | Limited to a maximum of 5,000 business kilometres per car. |

| Suitability | Best for those who use their car extensively for business purposes. | Best for those who use their car only occasionally for business purposes. |

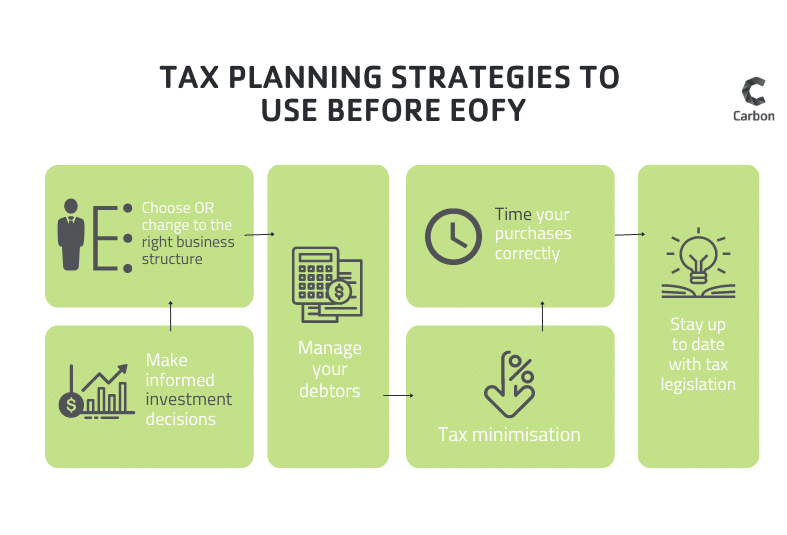

Planning Ahead: Proactive Steps for a Stress-Free Tax Time

Don’t wait until the last minute to start thinking about taxes. Proactive planning throughout the year can significantly reduce stress and improve your overall financial management.

- Set Aside Money for Taxes: Estimate your tax liability and set aside a portion of your income regularly to avoid a large tax bill at the end of the year.

- Review Your Financial Records Regularly: Don’t let things pile up. Review your records monthly or quarterly to identify any issues and ensure accuracy.

- Seek Professional Advice: Consider hiring an accountant or tax advisor to help you navigate the complexities of the Australian tax system. They can provide personalized advice and ensure you’re claiming all eligible deductions.

- Stay Up-to-Date on Tax Laws: Tax laws can change, so it’s important to stay informed about any updates that may affect your business. The ATO website is a valuable resource.

Preparing for tax time as a small business owner in Australia requires diligence, organization, and proactive planning. By implementing these strategies, you can simplify the process, minimize your tax liability, and focus on what matters most: growing your business. Remember, the key to a smooth tax season is preparedness, so start planning now for a less stressful and more profitable future.