Navigating the world of US loan options can seem daunting, especially for first-time borrowers. Understanding the different types of loans available, their terms, and the application process is crucial for making informed financial decisions. This comprehensive guide will illuminate the various avenues available, helping you discern the best path for your individual needs and financial circumstances. Successfully securing a loan requires careful planning and a thorough understanding of the lending landscape, so let’s begin exploring the world of US loan options.

Understanding Loan Types

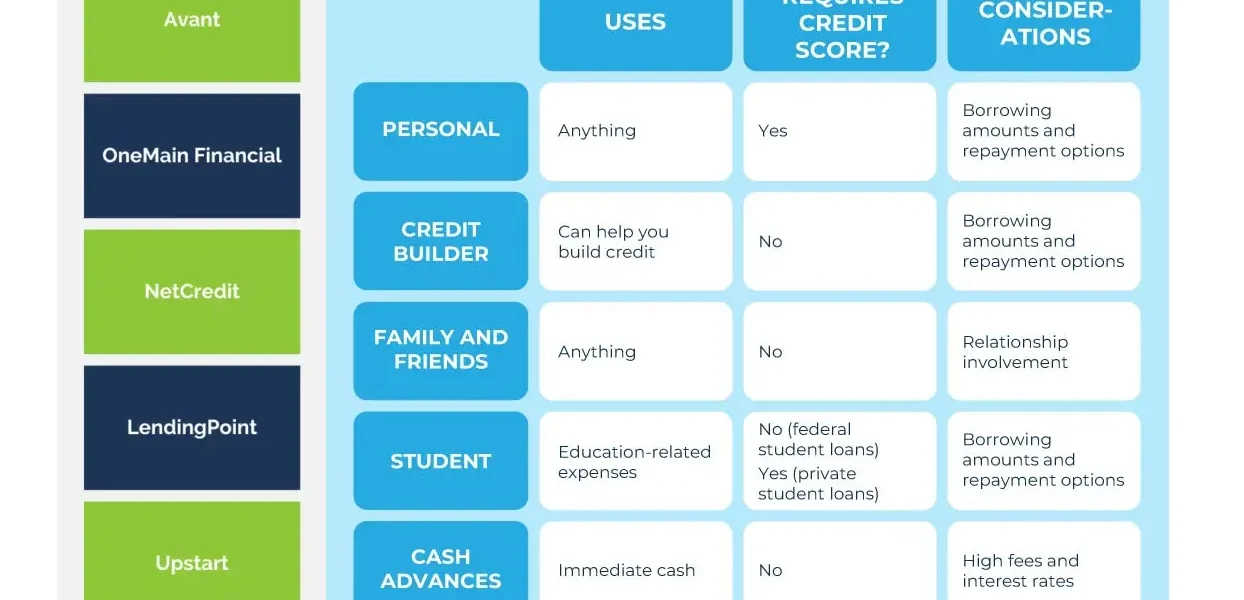

The United States offers a diverse range of loan products tailored to different purposes and borrower profiles. Here’s a breakdown of some common types:

- Personal Loans: Unsecured loans that can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses.

- Student Loans: Designed to cover the costs of higher education, often with deferred repayment options.

- Mortgages: Used to finance the purchase of a home, typically secured by the property itself.

- Auto Loans: Specifically for purchasing a vehicle, with the car serving as collateral.

- Small Business Loans: Intended to provide capital for starting or expanding a business.

Key Considerations Before Applying

Before jumping into the application process, carefully consider the following factors:

Credit Score:

Your credit score is a major determinant in loan approval and interest rates. A higher score generally translates to better terms.

Interest Rates:

Compare interest rates from multiple lenders to find the most favorable offer. Pay attention to both APR (Annual Percentage Rate) and the overall cost of the loan over its lifetime.

Repayment Terms:

Understand the repayment schedule, including the loan term, monthly payments, and any potential prepayment penalties;

Fees:

Be aware of any fees associated with the loan, such as origination fees, application fees, or late payment fees.

Comparing Loan Options: A Hypothetical Scenario

Let’s imagine you need to borrow $10,000. Here’s a simplified comparison between a personal loan and a credit card cash advance:

| Feature | Personal Loan | Credit Card Cash Advance |

|---|---|---|

| Interest Rate | Lower (e.g., 8-15%) | Higher (e.g., 15-25%) |

| Repayment Term | Fixed, typically 1-5 years | Variable, depends on minimum payments |

| Fees | Origination fees may apply | Cash advance fees apply |

| Credit Score Impact | Positive if managed well | Can negatively impact credit utilization |

As you can see, a personal loan might be a more advantageous option in this scenario, offering lower interest rates and a structured repayment plan. Careful consideration of these factors is crucial when evaluating loan options. Understanding the nuances of each type of loan is essential for making a responsible borrowing decision.

The Application Process

The application process typically involves providing personal and financial information, including income verification, employment history, and credit report authorization. Lenders will assess your creditworthiness and ability to repay the loan. Be prepared to provide supporting documentation, such as bank statements and pay stubs.

Ultimately, securing a loan is a significant financial undertaking. When considering US loan options, careful research, comparison shopping, and a thorough understanding of your own financial situation are paramount. Weighing the pros and cons of each loan type will empower you to make a well-informed decision that aligns with your long-term financial goals.

But what if your credit score isn’t stellar? Are there still avenues available? What about secured loans, where you offer collateral to mitigate the lender’s risk? Could that be a viable alternative if unsecured options seem out of reach?

Navigating Challenges and Seeking Guidance

Facing difficulties in obtaining a loan due to a low credit score or limited income? Have you considered exploring credit counseling services? Could they offer personalized advice and strategies for improving your financial standing? Are there government-backed loan programs specifically designed for individuals with specific needs or circumstances? And what about community development financial institutions (CDFIs)? Could they provide access to capital in underserved communities, offering more flexible terms than traditional lenders?

Avoiding Pitfalls: Are You Aware of Predatory Lending?

Are you vigilant about avoiding predatory lenders? Do you know the signs of a loan offer that’s too good to be true? Are you carefully scrutinizing the fine print, paying close attention to hidden fees and excessively high interest rates? Could falling prey to these practices trap you in a cycle of debt? And shouldn’t you always seek a second opinion before committing to any loan agreement, especially if it seems questionable?

The Future of Lending: What’s on the Horizon?

Have you heard about the rise of FinTech companies disrupting the lending landscape? Are they offering innovative loan products and streamlined application processes? Could peer-to-peer lending platforms provide a more accessible and transparent borrowing experience? And what about the potential impact of blockchain technology on the future of lending? Could it revolutionize the industry by enhancing security, reducing costs, and increasing efficiency?

So, are you now ready to confidently explore the myriad of US loan options? Knowing the landscape, understanding the risks, and seeking sound advice, are you prepared to make informed decisions that will benefit your financial future?